Question: Select 6-8 securities 1. Use the 'Asset Allocation' spreadsheet in course files Find the minimum variance portfolio with at least 5% invested in each security

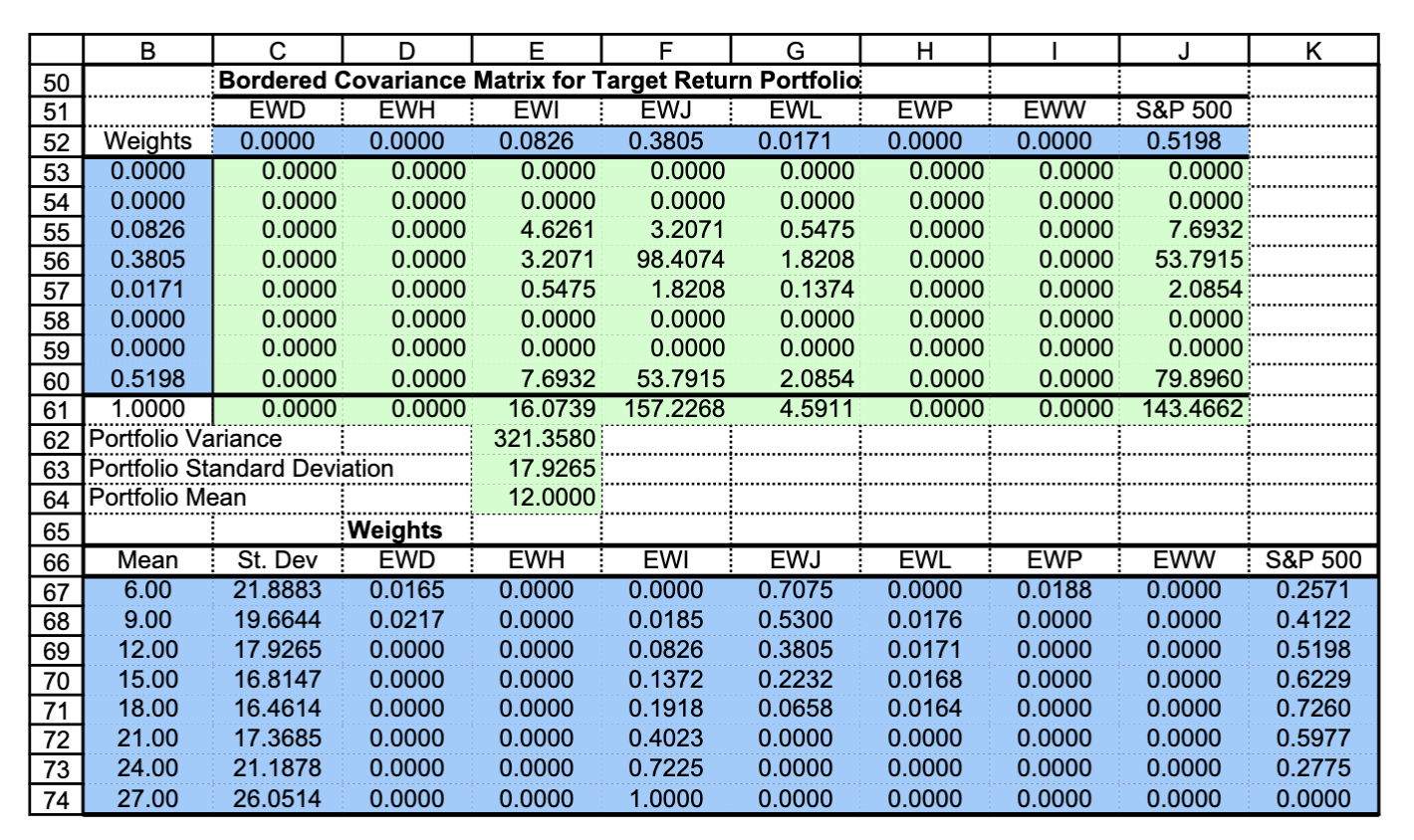

Select 6-8 securities 1. Use the 'Asset Allocation' spreadsheet in course files Find the minimum variance portfolio with at least 5% invested in each security and 100% of your 2. 3. wealth invested Find the minimum variance portfolio with at least 1% invested in each security and 100% of your 4. wealth invested While doing this exercise, note and explain any biases or heuristics in your behavior 5. D F G J K Bordered Covariance Matrix for Target Return Portfolio EWI 50 EWW EWD EWJ EWL EWP EWH S&P 500 51 0.0171 Weights 0.0826 0.0000 0.0000 0.0000 0.3805 0.0000 0.5198 52 0.0000 0.0000 0.0000 0.0000 O.0000 0.0000 0.0000 0.0000 0.0000 53 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 54 4.6261 0.0000 0.0826 0.0000 0.0000 3.2071 0.5475 0.0000 7.6932 55 1.8208 0.1374 53.7915 0.3805 0.0000 0.0000 3.2071 98.4074 0.0000 0.0000 56 0.5475 1.8208 0.0000 0.0000 0.0171 0.0000 0.0000 0.0000 0.0000 2.0854 57 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 58 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 59 0.0000 0.0000 79.8960 0.5198 0.0000 7.6932 53.7915 2.0854 0.0000 60 0.0000 1.0000 157.2268 O.0000 0.0000 16.0739 4.5911 0.0000 143.4662 61 62 Portfolio Variance 63 Portfolio Standard Deviation 64 Portfolio Mean 321.3580 17.9265 12.0000 Weights EWD 0.0165 65 EWJ EWL EWW S&P 500 ean St. Dev EWH EWI EWP 66 21.8883 6.00 0.0000 0.7075 0.0188 0.0000 0.0000 0.0000 0.2571 67 19.6644 9.00 0.0217 0.0000 0.0185 0.5300 0.0176 0.0000 0.0000 0.4122 68 12.00 17.9265 0.0000 0.0000 0.0826 0.3805 0.0171 0.0000 0.0000 0.5198 69 16.8147 0.0000 0.1372 0.1918 0.2232 0.0000 0.6229 15.00 0.0000 0.0168 0.0000 70 0.0000 0.0164 18.00 16.4614 0.0000 0.0658 0.0000 0.0000 0.7260 71 21.00 0.4023 17.3685 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.5977 72 0.0000 0.0000 24.00 21.1878 0.0000 0.0000 0.7225 O.0000 0.0000 0.2775 73 0.0000 0.0000 27.00 26.0514 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000 74 Select 6-8 securities 1. Use the 'Asset Allocation' spreadsheet in course files Find the minimum variance portfolio with at least 5% invested in each security and 100% of your 2. 3. wealth invested Find the minimum variance portfolio with at least 1% invested in each security and 100% of your 4. wealth invested While doing this exercise, note and explain any biases or heuristics in your behavior 5. D F G J K Bordered Covariance Matrix for Target Return Portfolio EWI 50 EWW EWD EWJ EWL EWP EWH S&P 500 51 0.0171 Weights 0.0826 0.0000 0.0000 0.0000 0.3805 0.0000 0.5198 52 0.0000 0.0000 0.0000 0.0000 O.0000 0.0000 0.0000 0.0000 0.0000 53 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 54 4.6261 0.0000 0.0826 0.0000 0.0000 3.2071 0.5475 0.0000 7.6932 55 1.8208 0.1374 53.7915 0.3805 0.0000 0.0000 3.2071 98.4074 0.0000 0.0000 56 0.5475 1.8208 0.0000 0.0000 0.0171 0.0000 0.0000 0.0000 0.0000 2.0854 57 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 58 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 59 0.0000 0.0000 79.8960 0.5198 0.0000 7.6932 53.7915 2.0854 0.0000 60 0.0000 1.0000 157.2268 O.0000 0.0000 16.0739 4.5911 0.0000 143.4662 61 62 Portfolio Variance 63 Portfolio Standard Deviation 64 Portfolio Mean 321.3580 17.9265 12.0000 Weights EWD 0.0165 65 EWJ EWL EWW S&P 500 ean St. Dev EWH EWI EWP 66 21.8883 6.00 0.0000 0.7075 0.0188 0.0000 0.0000 0.0000 0.2571 67 19.6644 9.00 0.0217 0.0000 0.0185 0.5300 0.0176 0.0000 0.0000 0.4122 68 12.00 17.9265 0.0000 0.0000 0.0826 0.3805 0.0171 0.0000 0.0000 0.5198 69 16.8147 0.0000 0.1372 0.1918 0.2232 0.0000 0.6229 15.00 0.0000 0.0168 0.0000 70 0.0000 0.0164 18.00 16.4614 0.0000 0.0658 0.0000 0.0000 0.7260 71 21.00 0.4023 17.3685 0.0000 0.0000 0.0000 0.0000 0.0000 0.0000 0.5977 72 0.0000 0.0000 24.00 21.1878 0.0000 0.0000 0.7225 O.0000 0.0000 0.2775 73 0.0000 0.0000 27.00 26.0514 1.0000 0.0000 0.0000 0.0000 0.0000 0.0000 74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts