Question: Q2. Calculate the profit or loss on the following option trades. CO 3 a. On April 15, trader A bought a EUR/USD call at

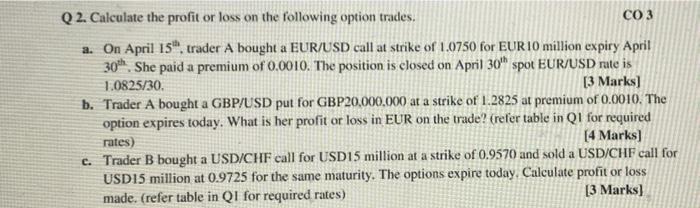

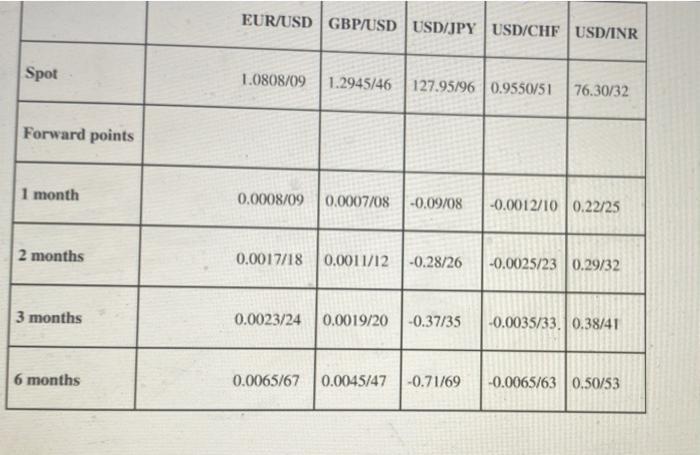

Q2. Calculate the profit or loss on the following option trades. CO 3 a. On April 15, trader A bought a EUR/USD call at strike of 1.0750 for EUR 10 million expiry April 30th. She paid a premium of 0.0010. The position is closed on April 30th spot EUR/USD rate is 1.0825/30. [3 marks] b. Trader A bought a GBP/USD put for GBP20,000,000 at a strike of 1.2825 at premium of 0.0010. The option expires today. What is her profit or loss in EUR on the trade? (refer table in Q1 for required [4 Marks] rates) c. Trader B bought a USD/CHF call for USD15 million at a strike of 0.9570 and sold a USD/CHF call for USD15 million at 0.9725 for the same maturity. The options expire today. Calculate profit or loss [3 Marks] made. (refer table in QI for required rates) Spot Forward points 1 month 2 months 3 months 6 months EUR/USD GBP/USD USD/JPY USD/CHF USD/INR 1.0808/09 1.2945/46 127.95/96 0.9550/51 76.30/32 0.0008/09 0.0007/08 -0.09/08 -0.0012/10 0.22/25 0.0017/18 0.0011/12 -0.28/26 0.0023/24 0.0019/20 -0.37/35 -0.0025/23 0.29/32 -0.0035/33, 0.38/41 0.0065/67 0.0045/47 -0.71/69 -0.0065/63 0.50/53

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

A A Trader Purchased a call option for 10 Million EURs Cost of ... View full answer

Get step-by-step solutions from verified subject matter experts