Question: Select [ Export ] from the drop down [File] menu to create an Excel worksheet of the General Fund post-closing trial balance as of December

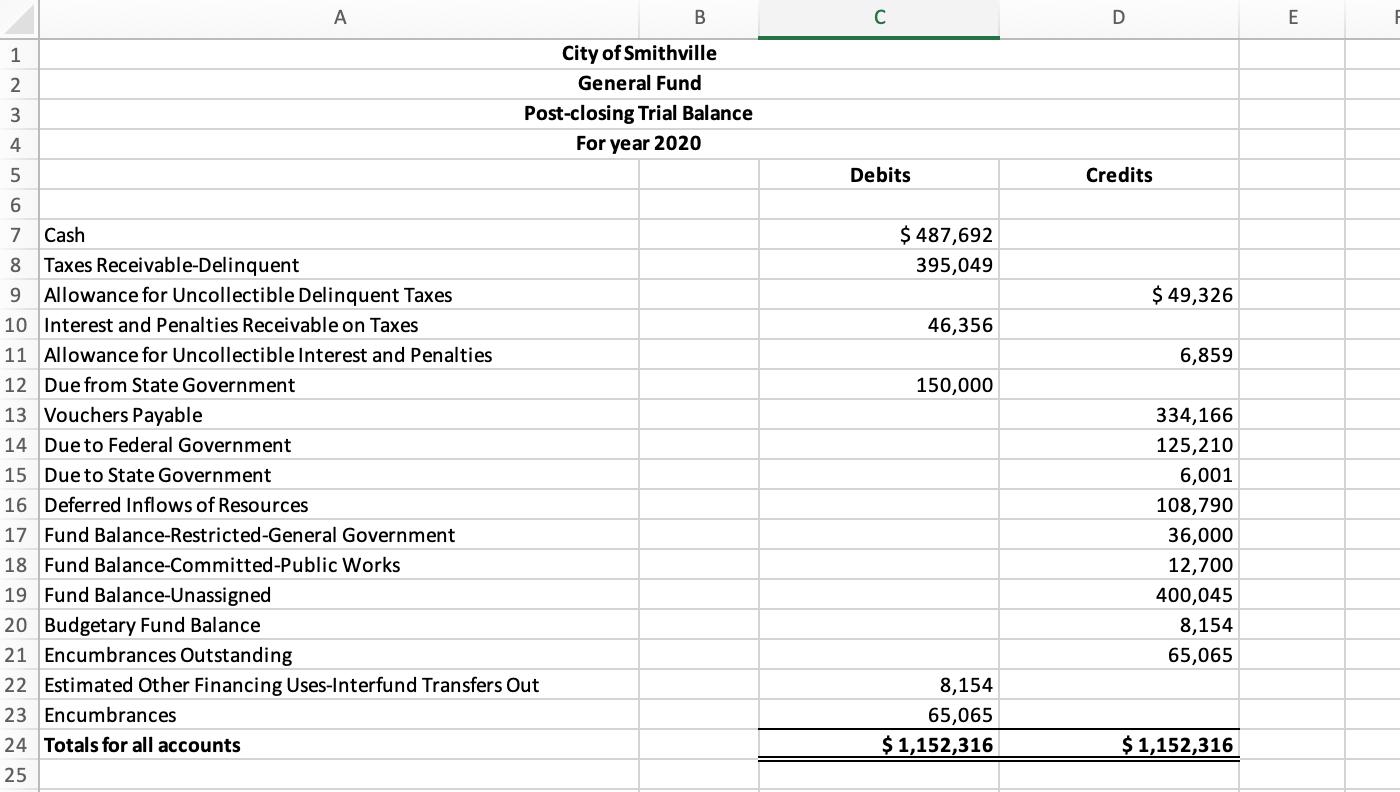

Select [Export] from the drop down [File] menu to create an Excel worksheet of the General Fund post-closing trial balance as of December 31, 2020. Use Excel to prepare in good form a balance sheet for the General Fund as of December 31, 2020. Follow the format shown in Illustration 4-4 of Reck, Lowensohn, and Neely, Accounting for Governmental & Nonprofit Entities, 18th edition textbook (hereafter referred to as “the textbook.”)

A 1 City of Smithville General Fund Post-closing Trial Balance 4 For year 2020 Debits Credits 7 Cash $ 487,692 8 Taxes Receivable-Delinquent 395,049 9. Allowance for Uncollectible Delinquent Taxes $ 49,326 10 Interest and Penalties Receivable on Taxes 46,356 11 Allowance for Uncollectible Interest and Penalties 6,859 12 Due from State Government 150,000 13 Vouchers Payable 334,166 14 Dueto Federal Government 125,210 15 Due to State Government 6,001 16 Deferred Inflows of Resources 108,790 17 Fund Balance-Restricted-General Government 36,000 18 Fund Balance-Committed-Public Works 12,700 19 Fund Balance-Unassigned 400,045 20 Budgetary Fund Balance 21 Encumbrances Outstanding 8,154 65,065 22 Estimated Other Financing Uses-Interfund Transfers Out 8,154 23 Encumbrances 65,065 24 Totals for all accounts $ 1,152,316 $1,152,316 25

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Solution Stalement of Balance sheet caly of Smitta ville Genecal tund Balance sheee D... View full answer

Get step-by-step solutions from verified subject matter experts