Question: Consider a household choosing a plan for current consumption C, and future consumption C according to the Fisher model with two time periods. Both

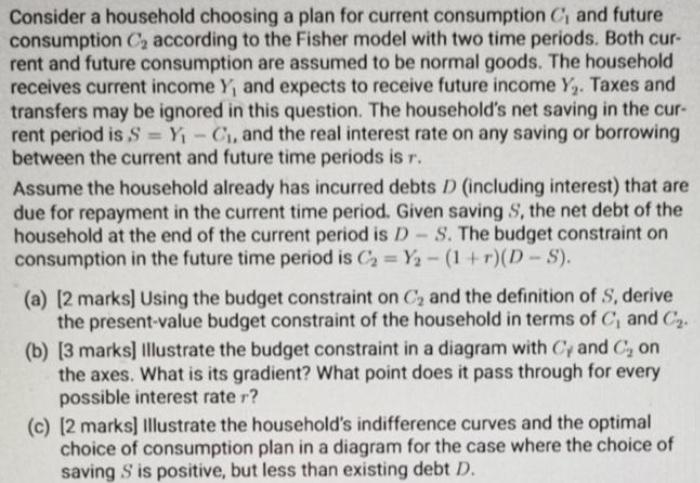

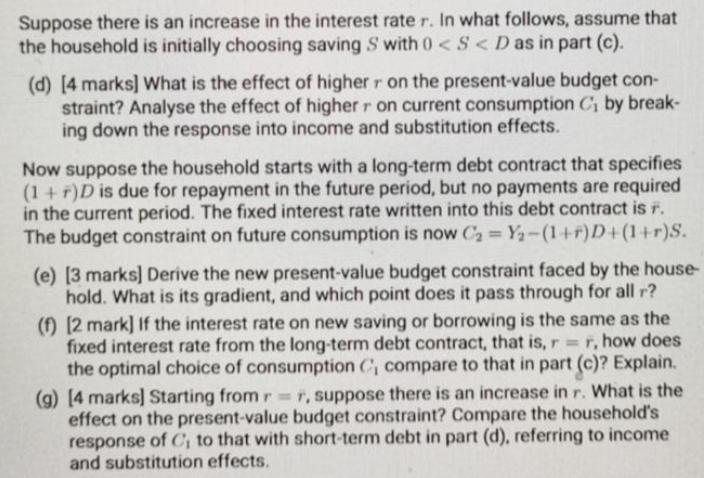

Consider a household choosing a plan for current consumption C, and future consumption C according to the Fisher model with two time periods. Both cur- rent and future consumption are assumed to be normal goods. The household receives current income Y, and expects to receive future income Y. Taxes and transfers may be ignored in this question. The household's net saving in the cur- rent period is S=Y-C, and the real interest rate on any saving or borrowing between the current and future time periods is r. Assume the household already has incurred debts D (including interest) that are due for repayment in the current time period. Given saving S, the net debt of the household at the end of the current period is D-S. The budget constraint on consumption in the future time period is C=Y-(1+r)(D-S). (a) [2 marks] Using the budget constraint on C and the definition of S, derive the present-value budget constraint of the household in terms of C, and C. (b) [3 marks] Illustrate the budget constraint in a diagram with Cy and C on the axes. What is its gradient? What point does it pass through for every possible interest rate r? (c) [2 marks] Illustrate the household's indifference curves and the optimal choice of consumption plan in a diagram for the case where the choice of saving S is positive, but less than existing debt D. Suppose there is an increase in the interest rate r. In what follows, assume that the household is initially choosing saving S with 0

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

a Now in pd L then S Y 9 2 ... View full answer

Get step-by-step solutions from verified subject matter experts