Question: Select the correct adjusting entry required at March 31, 2020 for each transaction described. Assume that for all transactions: The company prepares monthly financial

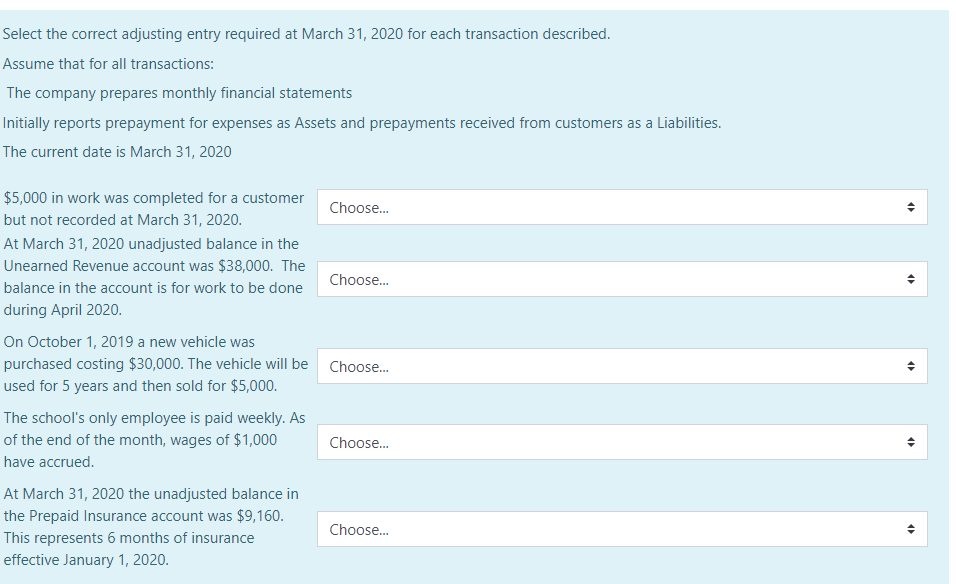

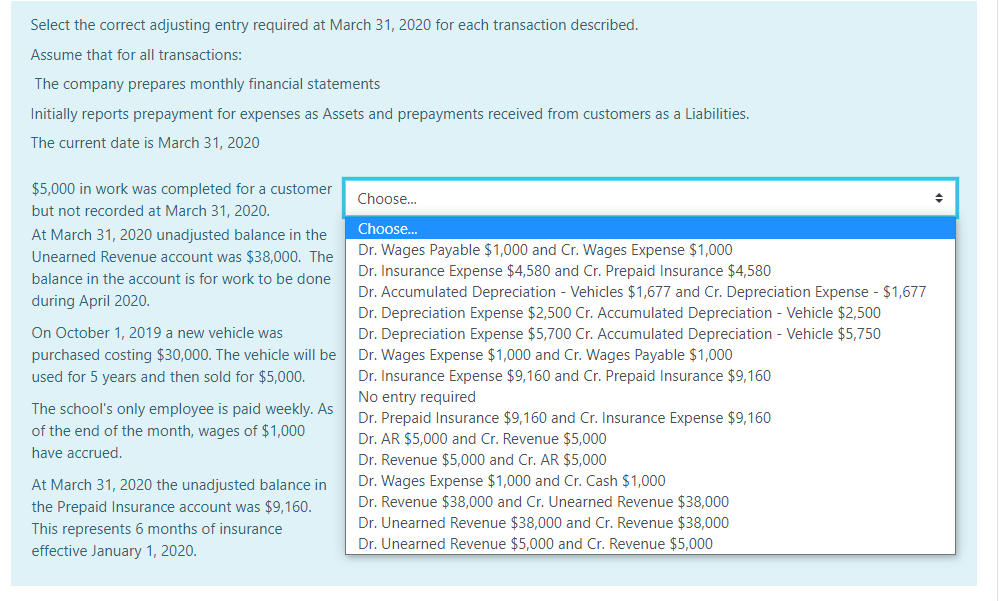

Select the correct adjusting entry required at March 31, 2020 for each transaction described. Assume that for all transactions: The company prepares monthly financial statements Initially reports prepayment for expenses as Assets and prepayments received from customers as a Liabilities. The current date is March 31, 2020 $5,000 in work was completed for a customer Choose. but not recorded at March 31, 2020. At March 31, 2020 unadjusted balance in the Unearned Revenue account was $38,000. The Choose. balance in the account is for work to be done during April 2020. On October 1, 2019 a new vehicle was purchased costing $30,000. The vehicle will be used for 5 years and then sold for $5,000. Choose. The school's only employee is paid weekly. As of the end of the month, wages of $1,000 Choose. have accrued. At March 31, 2020 the unadjusted balance in the Prepaid Insurance account was $9,160. Choose. This represents 6 months of insurance effective January 1, 2020. Select the correct adjusting entry required at March 31, 2020 for each transaction described. Assume that for all transactions: The company prepares monthly financial statements Initially reports prepayment for expenses as Assets and prepayments received from customers as a Liabilities. The current date is March 31, 2020 $5,000 in work was completed for a customer Choose. but not recorded at March 31, 2020. Choose. At March 31, 2020 unadjusted balance in the Unearned Revenue account was $38,000. The Dr. Wages Payable $1,000 and Cr. Wages Expense $1,000 Dr. Insurance Expense $4,580 and Cr. Prepaid Insurance $4,580 Dr. Accumulated Depreciation - Vehicles $1,677 and Cr. Depreciation Expense - $1,677 Dr. Depreciation Expense $2,500 Cr. Accumulated Depreciation - Vehicle $2,500 Dr. Depreciation Expense $5,700 Cr. Accumulated Depreciation - Vehicle $5,750 Dr. Wages Expense $1,000 and Cr. Wages Payable $1,000 Dr. Insurance Expense $9,160 and Cr. Prepaid Insurance $9,160 No entry required Dr. Prepaid Insurance $9,160 and Cr. Insurance Expense $9,160 Dr. AR $5,000 and Cr. Revenue $5,000 Dr. Revenue $5,000 and Cr. AR $5,000 Dr. Wages Expense $1,000 and Cr. Cash $1,000 Dr. Revenue $38,000 and Cr. Unearned Revenue $38,000 balance in the account is for work to be done during April 2020. On October 1, 2019 a new vehicle was purchased costing $30,000. The vehicle will be used for 5 years and then sold for $5,000. The school's only employee is paid weekly. As of the end of the month, wages of $1,000 have accrued. At March 31, 2020 the unadjusted balance in the Prepaid Insurance account was $9,160. Dr. Unearned Revenue $38,000 and Cr. Revenue $38,000 This represents 6 months of insurance Dr. Unearned Revenue $5,000 and Cr. Revenue $5,000 effective January 1, 2020.

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

1 Araccounts receivable ac dr 5000 to revenue ac 5000 being work comple... View full answer

Get step-by-step solutions from verified subject matter experts