Question: Select the correct journal entry for each transaction. Choose... Choose... June 1: XYZ Company sold merchandise to ABC Company for $9,500; terms 2/5, n/15, FOB

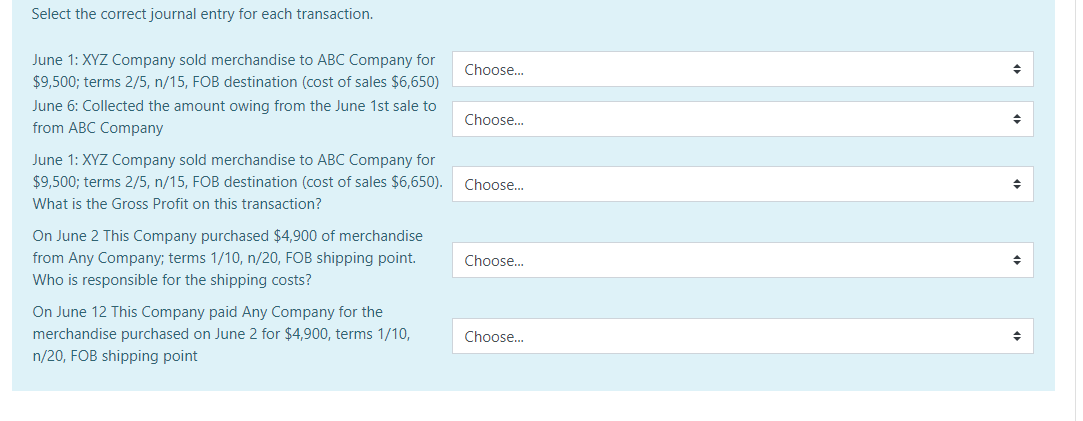

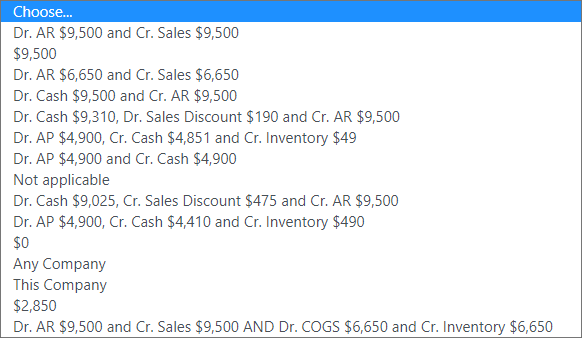

Select the correct journal entry for each transaction. Choose... Choose... June 1: XYZ Company sold merchandise to ABC Company for $9,500; terms 2/5, n/15, FOB destination (cost of sales $6,650) June 6: Collected the amount owing from the June 1st sale to from ABC Company June 1: XYZ Company sold merchandise to ABC Company for $9,500; terms 2/5, n/15, FOB destination (cost of sales $6,650). What is the Gross Profit on this transaction? Choose... Choose... On June 2 This Company purchased $4,900 of merchandise from Any Company; terms 1/10, n/20, FOB shipping point. Who is responsible for the shipping costs? On June 12 This Company paid Any Company for the merchandise purchased on June 2 for $4,900, terms 1/10, n/20, FOB shipping point Choose... Choose... Dr. AR $9,500 and Cr. Sales $9,500 $9,500 Dr. AR $6,650 and Cr. Sales $6,650 Dr. Cash $9,500 and Cr. AR $9,500 Dr. Cash $9,310, Dr. Sales Discount $190 and Cr. AR $9,500 Dr. AP $4,900, Cr. Cash $4,851 and Cr. Inventory $49 Dr. AP $4,900 and Cr. Cash $4,900 Not applicable Dr. Cash $9,025, Cr. Sales Discount $475 and Cr. AR $9,500 Dr. AP $4,900, Cr. Cash $4,410 and Cr. Inventory $490 $0 Any Company This Company $2,850 Dr. AR $9,500 and Cr. Sales $9,500 AND Dr. COGS $6,650 and Cr. Inventory $6,650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts