Question: Select TWO that are FALSE: Do not try to click on all! Negative points will be given for any incorrectly clicked answers. Sale-leaseback-of-the-land looks like

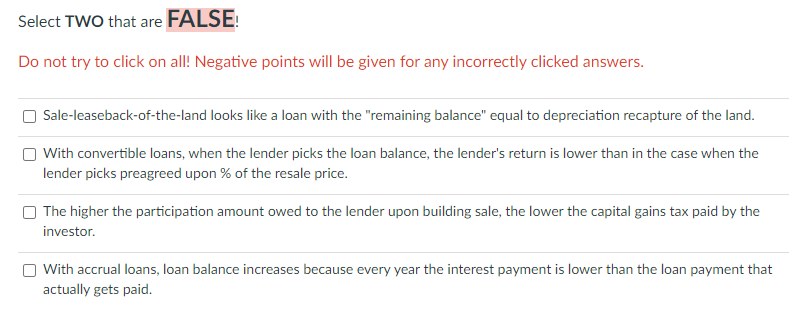

Select TWO that are FALSE: Do not try to click on all! Negative points will be given for any incorrectly clicked answers. Sale-leaseback-of-the-land looks like a loan with the "remaining balance" equal to depreciation recapture of the land. With convertible loans, when the lender picks the loan balance, the lender's return is lower than in the case when the lender picks preagreed upon % of the resale price. The higher the participation amount owed to the lender upon building sale, the lower the capital gains tax paid by the investor. With accrual loans, loan balance increases because every year the interest payment is lower than the loan payment that actually gets paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts