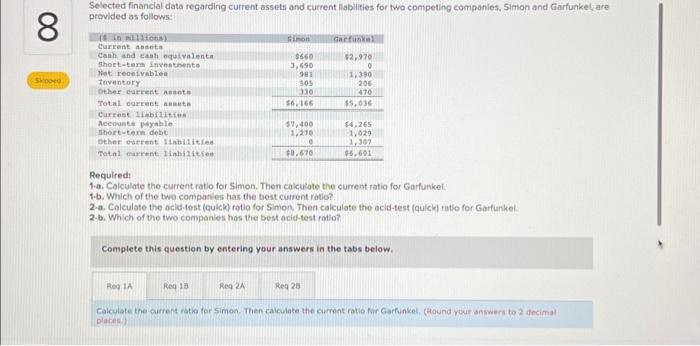

Question: Selected financial data regarding current assets and current liabilities for two competing companies, Simon and Garfunkel, are provided as follows: ($ in millions) Current assets

Selected financial data regarding current assets and current liabilities for two competing companies, Simon and Garfunkel, are provided os follows: Required: 1.a. Colculote the current ratio for Simon. Then calculate the current ratio for Garfunicel. 1.b. Which of the two companies has the best current ratio? 2-a. Calculate the acld-test (qulck ratio for Simon. Then calculate the acid-test (quick) ratio for Garfunkel. 2-b. Which of the two companies has the best acid-test rotio? Complete this question by entering your answers in the tabs below. Calculate the current ratio for Simon. Then calculate the curment rotio for Garfunkel, (Hound vour answeri to 2 decima plactes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts