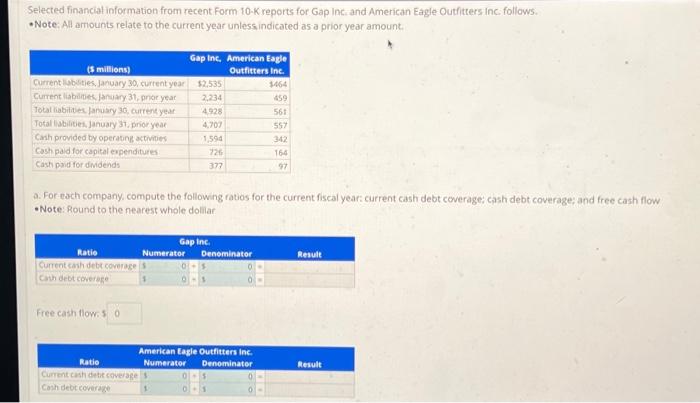

Question: Selected financial information from recent Form 10-K reports for Gap Inci and American Eagle Outfitters inc. follows. - Note. All amounts relate to the current

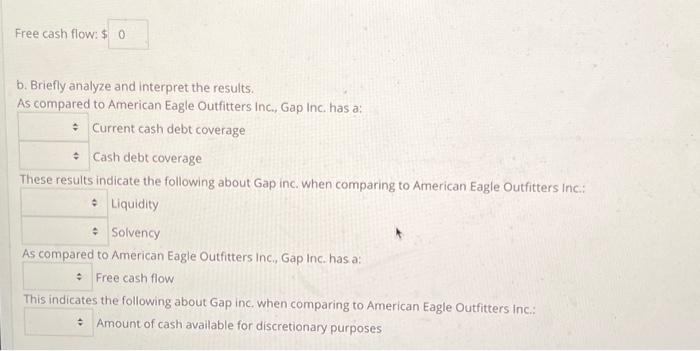

Selected financial information from recent Form 10-K reports for Gap Inci and American Eagle Outfitters inc. follows. - Note. All amounts relate to the current year unless indicated as a prior year amount. a. For each company. compute the following ratios for the current fiscal year: current cash debt coverage: cash debt coverage; and free cash flow - Note: Round to the nearest whole dollar Free cash flow: 5 b. Briefly analyze and interpret the results. As compared to American Eagle Outfitters inc., Gap Inc. has a: Current cash debt coverage Cash debt coverage These results indicate the following about Gap inc. When comparing to American Eagle Outfitters Inc: Liquidity Solvency As compared to American Eagle Outfitters inc., Gap inc. has a: Free cash flow This indicates the following about Gap inc. when comparing to American Eagle Outfitters inc: Amount of cash available for discretionary purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts