Question: Selected financial information from recent Form 10-K reports for Gap Inc. and American Eagle Outfitters Inc. follows. Note: All amounts relate to the current

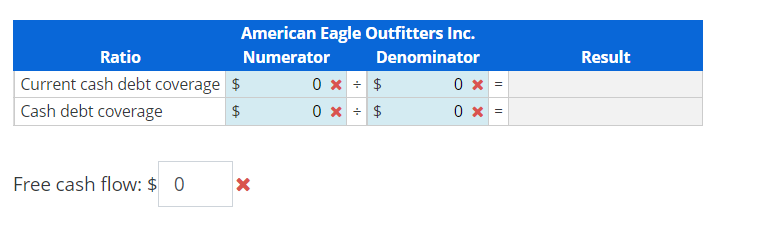

Selected financial information from recent Form 10-K reports for Gap Inc. and American Eagle Outfitters Inc. follows. Note: All amounts relate to the current year unless indicated as a prior year amount. ($ millions) Current liabilities, January 30, current year Current liabilities, January 31, prior year Total liabilities, January 30, current year Total liabilities, January 31, prior year Cash provided by operating activities Cash paid for capital expenditures Cash paid for dividends Ratio Current cash debt coverage $ Cash debt coverage $ Free cash flow: $ 0 Numerator Gap Inc, American Eagle Outfitters Inc. $232 230 281 279 149 82 49 a. For each company, compute the following ratios for the current fiscal year: current cash debt coverage; cash debt coverage; and free cash flow Note: Round to the nearest whole dolllar X $1,268 1,117 2,464 2,354 694 363 189 Gap Inc. Denominator 2,464 * = 1,268 * = 505 x + $ 694 + $ Result 0.2 0.55 Ratio Current cash debt coverage Cash debt coverage Free cash flow: $ 0 American Eagle Outfitters Inc. Numerator Denominator $ $ X 0x + $ 0x = $ 0x = 0 x Result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts