Question: Selected financial statement information and additional data for Pharoah Enterprises is presented below: Pharoah Enterprises Balance Sheet and Income Statement Data December 31, 2020 December

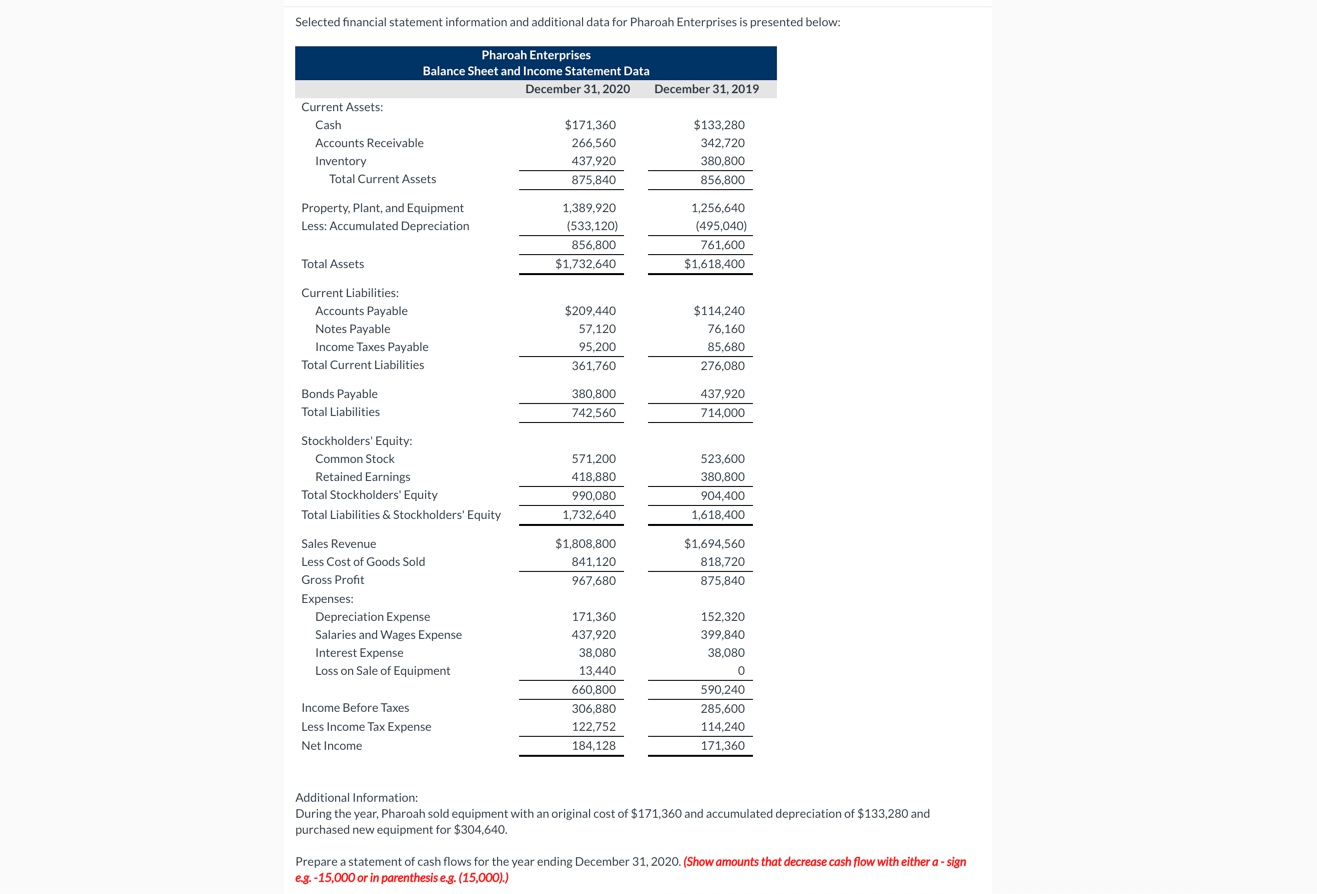

Selected financial statement information and additional data for Pharoah Enterprises is presented below: Pharoah Enterprises Balance Sheet and Income Statement Data December 31, 2020 December 31, 2019 Current Assets: Cash $171,360 $133,280 Accounts Receivable 266,560 342,720 Inventory 437.920 380,800 Total Current Assets 875,840 856,800 Property, Plant, and Equipment Less: Accumulated Depreciation 1,389.920 (533,120) 856.800 $1,732,640 1,256,640 (495,040) 761,600 $1,618,400 Total Assets Current Liabilities: Accounts Payable Notes Payable Income Taxes Payable Total Current Liabilities $209,440 57,120 95,200 361,760 $114.240 76,160 85,680 276,080 Bonds Payable Total Liabilities 380,800 742.560 437.920 714,000 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 571,200 418,880 990,080 1,732.640 523,600 380.800 904,400 1,618,400 $1,808.800 841,120 967,680 $1,694,560 818,720 875,840 Sales Revenue Less Cost of Goods Sold Gross Profit Expenses: Depreciation Expense Salaries and Wages Expense Interest Expense Loss on Sale of Equipment 171,360 437.920 38,080 13,440 660,800 306,880 122.752 184,128 152,320 399,840 38,080 0 590,240 285,600 114.240 171,360 Income Before Taxes Less Income Tax Expense Net Income Additional Information: During the year, Pharoah sold equipment with an original cost of $171,360 and accumulated depreciation of $133,280 and purchased new equipment for $304,640. Prepare a statement of cash flows for the year ending December 31, 2020. (Show amounts that decrease cash flow with either a-sign eg.-15,000 or in parenthesis e.g. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts