Question: Selected financial statement information for Long Corp. for the year ended December 31, 2019, is as follows: 2019 2018 Balance sheet Employee benefits payable

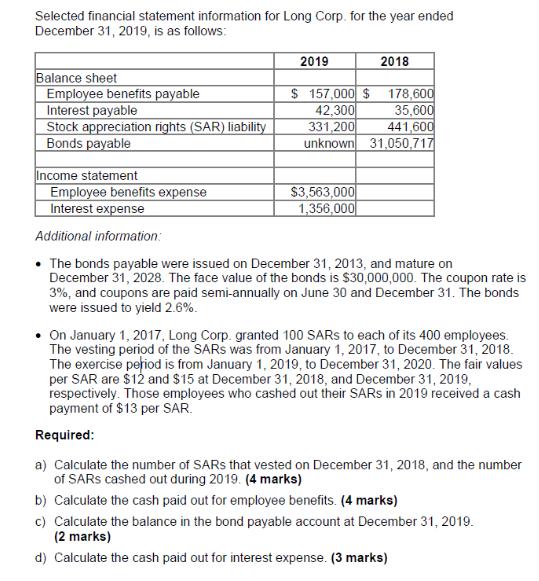

Selected financial statement information for Long Corp. for the year ended December 31, 2019, is as follows: 2019 2018 Balance sheet Employee benefits payable $ 157,000 $ 178,600 Interest payable 42,300 35,600 Stock appreciation rights (SAR) liability 331,200 441,600 Bonds payable unknown 31,050,717 Income statement Employee benefits expense $3,563,000 1,356,000 Interest expense Additional information: The bonds payable were issued on December 31, 2013, and mature on December 31, 2028. The face value of the bonds is $30,000,000. The coupon rate is 3%, and coupons are paid semi-annually on June 30 and December 31. The bonds were issued to yield 2.6%. On January 1, 2017, Long Corp. granted 100 SARS to each of its 400 employees. The vesting period of the SARS was from January 1, 2017, to December 31, 2018. The exercise period is from January 1, 2019, to December 31, 2020. The fair values per SAR are $12 and $15 at December 31, 2018, and December 31, 2019, respectively. Those employees who cashed out their SARS in 2019 received a cash payment of $13 per SAR. Required: a) Calculate the number of SARS that vested on December 31, 2018, and the number of SARS cashed out during 2019. (4 marks) b) Calculate the cash paid out for employee benefits. (4 marks) c) Calculate the balance in the bond payable account at December 31, 2019. (2 marks) d) Calculate the cash paid out for interest expense. (3 marks)

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

a b C d Fair Value of SAR as on December 31 2018 SAR as per balance sheet as on above date Therefore ... View full answer

Get step-by-step solutions from verified subject matter experts