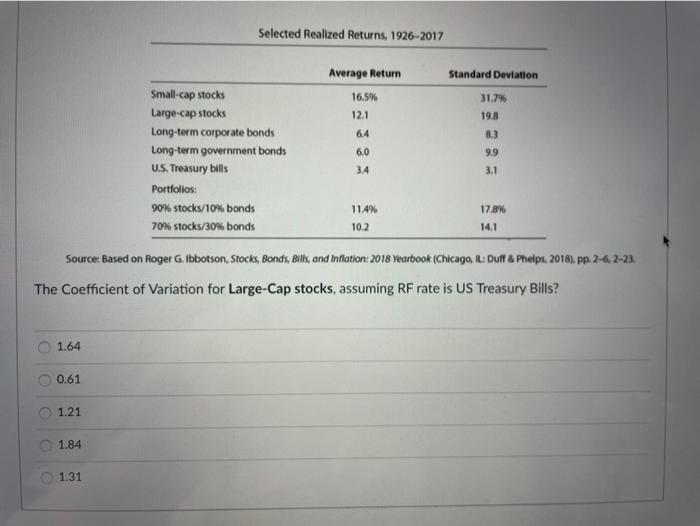

Question: Selected Realized Returns, 1926-2017 6.4 8.3 3.4 Average Return Standard Deviation Small-cap stocks 16.5% 31.7% Large-cap stocks 12.1 19.8 Long-term corporate bonds Long-term government bonds

Selected Realized Returns, 1926-2017 6.4 8.3 3.4 Average Return Standard Deviation Small-cap stocks 16.5% 31.7% Large-cap stocks 12.1 19.8 Long-term corporate bonds Long-term government bonds 6,0 9.9 U.S. Treasury bills 3.1 Portfolios: 90% stocks/10% bonds 11.4% 178% 70% stocks/30% bonds Source: Based on Roger G. Ibbotson, Stocks, Bonds, Bills, and Inflation: 2018 Yearbook (Chicago, IL: Duff & Phelps, 2018), pp. 2-6, 2-22. The Coefficient of Variation for Large-Cap stocks, assuming RF rate is US Treasury Bills? 10.2 14.1 1.64 0.61 1.21 1.84 1.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts