Question: send asmwer asappp Question 1: The following regression model was estimated to forecast the value of the Indian rupee ( INR) :DNR1a0+a1 INT 1+a2 INF

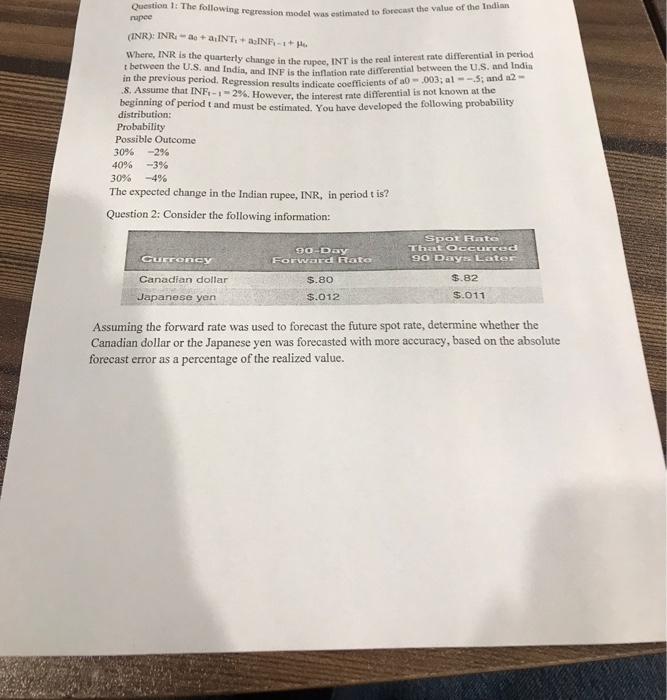

Question 1: The following regression model was estimated to forecast the value of the Indian rupee ( INR) :DNR1a0+a1 INT 1+a2 INF 11+4 Where, INR is the quarterly change in the nupee, INT is the real intereat rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and Indin in the previous period. Regression results indicate cocfficients of a0 =.003;a15; and a 2= 8. Assume that INE 1=2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution: Probability Possible Outcome 30%40%30%2%3%4% The expected change in the Indian rupee, INR, in period t is? Question 2: Consider the following information: Assuming the forward rate was used to forecast the future spot rate, determine whether the Canadian dollar or the Japanese yen was forecasted with more accuracy, based on the absolute forecast error as a percentage of the realized value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts