Question: Senior management at Humber bakery requested a new analysis based on adjusting the selling price and the number of units produced under each production plan.

Senior management at Humber bakery requested a new analysis based on adjusting the selling price and the number of units produced under each production plan. Initial probability estimates are also updated. Resulting gross profits ($) and state of nature probabilities are given in the following payoff table.

Low Demand

Medium Demand High Demand Light

Production 55,55085,00085,000 Moderate

Production 43,100102,000102,000 Heavy

Production 5,75064,650123,550 Probability

0.20.50.3

a) [8 marks] What is the optimal decision using the minimax regret approach? Show your work.

The new analysis also necessitated updating the offer made to Bramptinos under the heavy production plan. The probability that Bramptinos will accept the new offer is 26% and the associated gross profit is determined to be $112,500. Again here, if Bramptinos declines the offer, the loaves will still sell based on current demand conditions (low, medium, or high).

b) [8 marks] Using the decision tree you selected from Part B along with the payoffs and probabilities provided in this section, construct a decision tree for the problem. (You can draw manually or use software. Marks will be given for presentation). What is the optimal decision in this case? Why?

Before making a final decision on the production plan to adopt, the bakery's manager decides to contact Professor Leung in the Math Department to conduct a market research survey. The results of the survey will indicate either favourable or unfavourable market conditions for premium breads.

In the past, when there was Low Demand, Professor Leung's predictions were unfavorable 80% of the time. The professor's predictions have also been favourable given Medium Demand 88% of the time, and unfavourable given High Demand 10% of the time.

c) [12 marks] Calculate posterior (revised) probabilities (Round to 3 decimal places; do not round intermediate results). Show calculations or tables.

d) [25 marks] Construct a multistage decision tree (based on part b) with the additional information from Professor Leung.

e) [2 marks] What is the value of the sample information (EVSI) provided by Professor Leung?

f) [3 marks] State the optimal decision strategy if Professor Leung's consulting fees were $500.

g) [2 marks] Does the strategy change if Professor Leung's consulting fees were $1500? If yes, state the new optimal strategy? If no, explain.

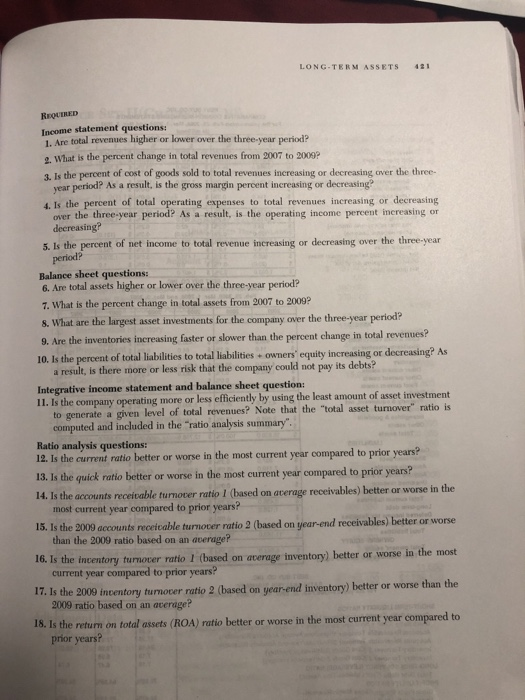

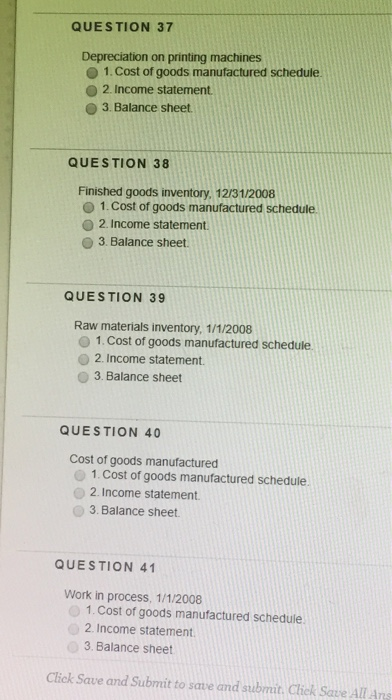

LONG-TERM ASSETS 121 REQUIRED Income statement questions: 1. Are total revenues higher or lower over the three-year period? 2. What is the percent change in total revenues from 2007 to 2009? 3. Is the percent of cost of goods sold to total revenues increasing or decreasing over the three- year period? As a result, is the gross margin percent increasing or decreasing" 4. Is the percent of total operating expenses to total revenues increasing or decreasing over the three-year period? As a result, is the operating income percent increasing or decreasing? 5. Is the percent of net income to total revenue increasing or decreasing over the three-year period? Balance sheet questions: 6. Are total assets higher or lower over the three-year period? 7. What is the percent change in total assets from 2007 to 2009? 8. What are the largest asset investments for the company over the three-year period? 9. Are the inventories increasing faster or slower than the percent change in total revenues? 10. Is the percent of total liabilities to total liabilities + owners' equity increasing or decreasing? As a result, is there more or less risk that the company could not pay its debts? Integrative income statement and balance sheet question: 1 1. Is the company operating more or less efficiently by using the least amount of asset investment to generate a given level of total revenues? Note that the "total asset turnover" ratio is computed and included in the "ratio analysis summary". Ratio analysis questions: 12. Is the current ratio better or worse in the most current year compared to prior years? 13. Is the quick ratio better or worse in the most current year compared to prior years? 14. Is the accounts receivable turnover ratio I (based on average receivables) better or worse in the most current year compared to prior years? 15. Is the 2009 accounts receivable turnover ratio 2 (based on year-end receivables) better or worse than the 2009 ratio based on an average? 16. Is the inventory turnover ratio I (based on average inventory) better or worse in the most current year compared to prior years? 17. Is the 2009 inventory turnover ratio 2 (based on year-end inventory) better or worse than the 2009 ratio based on an average? 18. Is the return on total assets (ROA) ratio better or worse in the most current year compared to prior years?Question 1 :1 point: Semistrong form efficiency implies: I a] All historical market information, including prices and volume. is included in the price. I b] All information, both public and private is already incorporated in the price. I c} Superior returns may be obtained by the analysis of past prices and volumes. d] All public information is already incorporated in the price. Question 211 point]- Which ofthe following is NOT an empirical challenge to market efficiency? I a] small stocks tend to outperform large stocks I b] value stocks tend to outperform growth stocks I c] investors appear to react slowly to earnings announcements di stocks sometimes return more than their expected return s, and at othertimes return less than their expected returns Question 3 [1 point]- Which ofthe following should not lead to an increase in market efciency? I a] Information is available faster I b] Infon'nation is available at a lower cost cjl There are more assets {for example, number of stocks) in the market for the same number of market participants I d] There are more participants in the markets for the same number ofassets Question 411 polnt] An exchange rate regime is one under which rates of exchange are determined in the market on the basis of predominantly private transactions is called: \fGeneral Balance Sheet Questions If the account is a CURRENT ASSET mark as TRUE: True Inventory False True Temporary Investments False True False Equipment True False Dividends True False Accounts Receivable Long-term Investments False True False Prepaid Insurance True Rent Expense False .True Supplies False True False Cash Which reflects Current Assets in the proper order: Equipment (net) on the balance sheet is the Equipment account balance minus In the Stockholders' Equity section of a Balance Sheet which is listed firstQUESTION 37 Depreciation on printing machines 1. Cost of goods manufactured schedule. 2. Income statement. O 3. Balance sheet. QUESTION 38 Finished goods inventory, 12/31/2008 1. Cost of goods manufactured schedule O 2. Income statement. O 3. Balance sheet. QUESTION 39 Raw materials inventory, 1/1/2008 1. Cost of goods manufactured schedule 2. Income statement. 3. Balance sheet QUESTION 40 Cost of goods manufactured 1. Cost of goods manufactured schedule. 2. Income statement. O 3. Balance sheet. QUESTION 41 Work in process, 1/1/2008 1. Cost of goods manufactured schedule 2. Income statement. 3. Balance sheet Click Save and Submit to save and submit. Click Save All Ans

Step by Step Solution

There are 3 Steps involved in it

from PIL import Image import pytesseract import pandas as pd Load and extract text from all uploaded ... View full answer

Get step-by-step solutions from verified subject matter experts