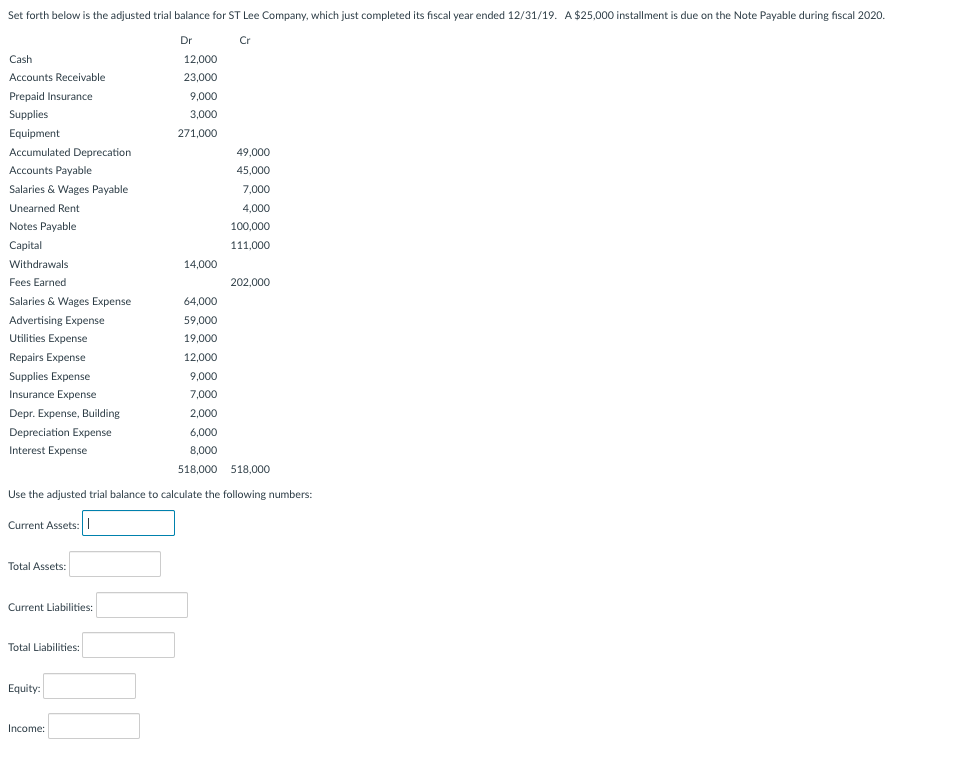

Question: Set forth below is the adjusted trial balance for ST Lee Company, which just completed its fiscal year ended 12/31/19. A $25,000 installment is

Set forth below is the adjusted trial balance for ST Lee Company, which just completed its fiscal year ended 12/31/19. A $25,000 installment is due on the Note Payable during fiscal 2020. Dr Cr Cash 12,000 Accounts Receivable 23,000 Prepaid Insurance 9,000 Supplies 3,000 Equipment 271,000 Accumulated Deprecation 49,000 Accounts Payable 45,000 Salaries & Wages Payable 7,000 Unearned Rent 4,000 Notes Payable 100,000 Capital 111,000 Withdrawals 14,000 Fees Earned 202,000 Salaries & Wages Expense 64,000 Advertising Expense 59,000 Utilities Expense 19,000 Repairs Expense 12,000 Supplies Expense 9,000 Insurance Expense 7,000 Depr. Expense, Building 2,000 Depreciation Expense 6.000 Interest Expense 8,000 518,000 518,000 Use the adjusted trial balance to calculate the following numbers: Current Assets: Total Assets: Current Liabilities: Total Liabilities: Equity: Income:

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Current Assets Particulars Amount Cash 12000 Accounts receivable 23000 Prepaid insurance 9000 Suppli... View full answer

Get step-by-step solutions from verified subject matter experts