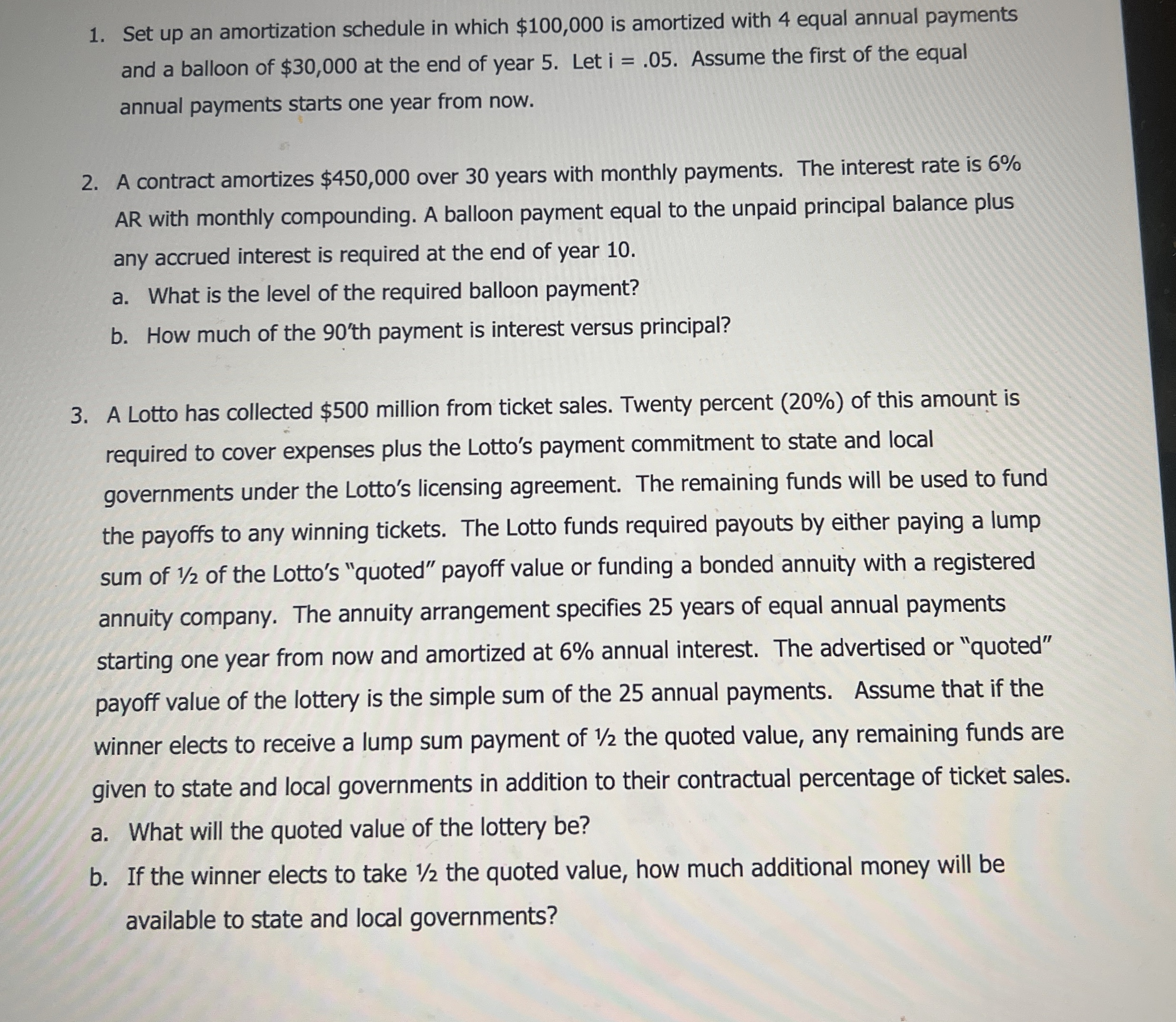

Question: Set up an amortization schedule in which $ 1 0 0 , 0 0 0 is amortized with 4 equal annual payments and a balloon

Set up an amortization schedule in which $ is amortized with equal annual payments

and a balloon of $ at the end of year Let Assume the first of the equal

annual payments starts one year from now.

A contract amortizes $ over years with monthly payments. The interest rate is

AR with monthly compounding. A balloon payment equal to the unpaid principal balance plus

any accrued interest is required at the end of year

a What is the level of the required balloon payment?

b How much of the th payment is interest versus principal?

A Lotto has collected $ million from ticket sales. Twenty percent of this amount is

required to cover expenses plus the Lotto's payment commitment to state and local

governments under the Lotto's licensing agreement. The remaining funds will be used to fund

the payoffs to any winning tickets. The Lotto funds required payouts by either paying a lump

sum of of the Lotto's "quoted" payoff value or funding a bonded annuity with a registered

annuity company. The annuity arrangement specifies years of equal annual payments

starting one year from now and amortized at annual interest. The advertised or "quoted"

payoff value of the lottery is the simple sum of the annual payments. Assume that if the

winner elects to receive a lump sum payment of the quoted value, any remaining funds are

given to state and local governments in addition to their contractual percentage of ticket sales.

a What will the quoted value of the lottery be

b If the winner elects to take the quoted value, how much additional money will be

available to state and local governments?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock