Question: * Set up linear first order differential equations * Solve the differential equation * Use the function solution to answer the questions * Assume a

* Set up linear first order differential equations

* Solve the differential equation

* Use the function solution to answer the questions

* Assume a 6% annual continuous interest rate and all deposits as well as withdrawals are made in a continuous fashion

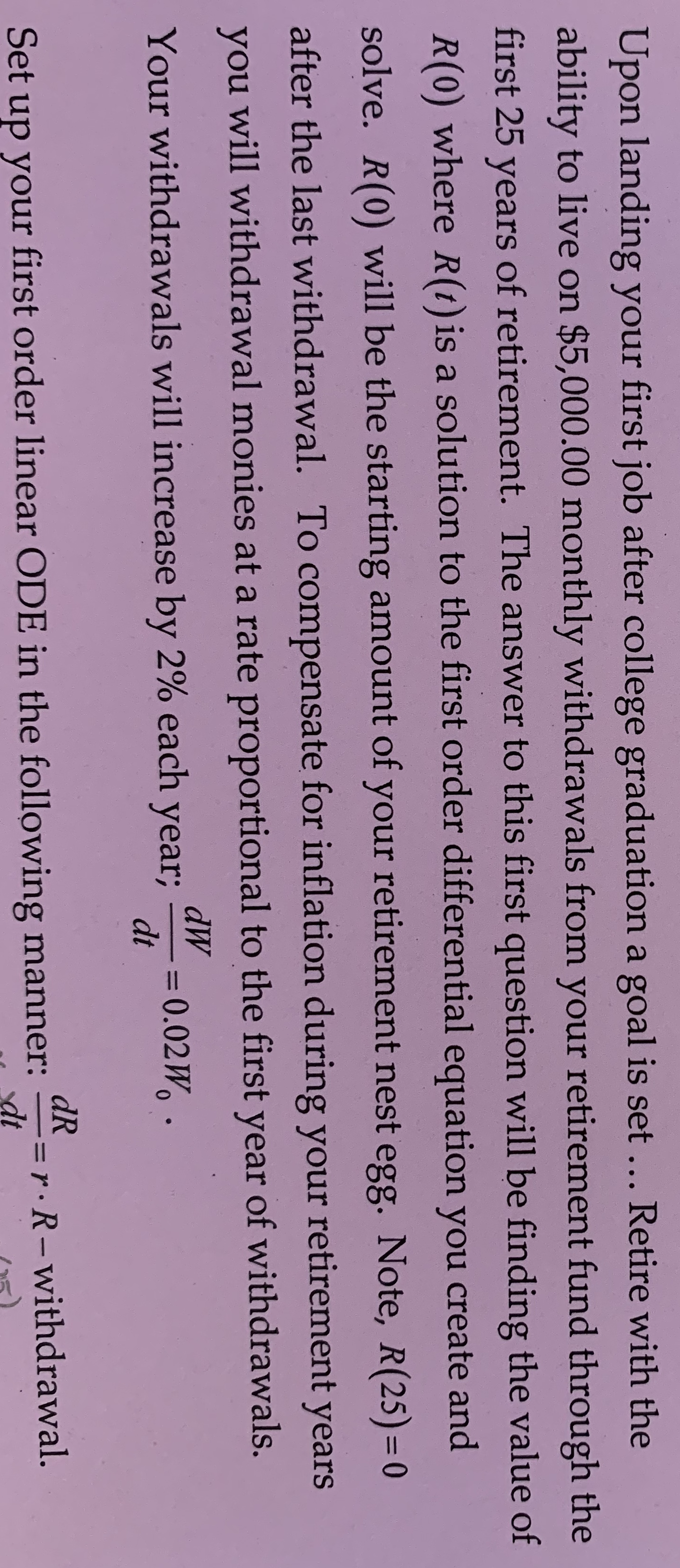

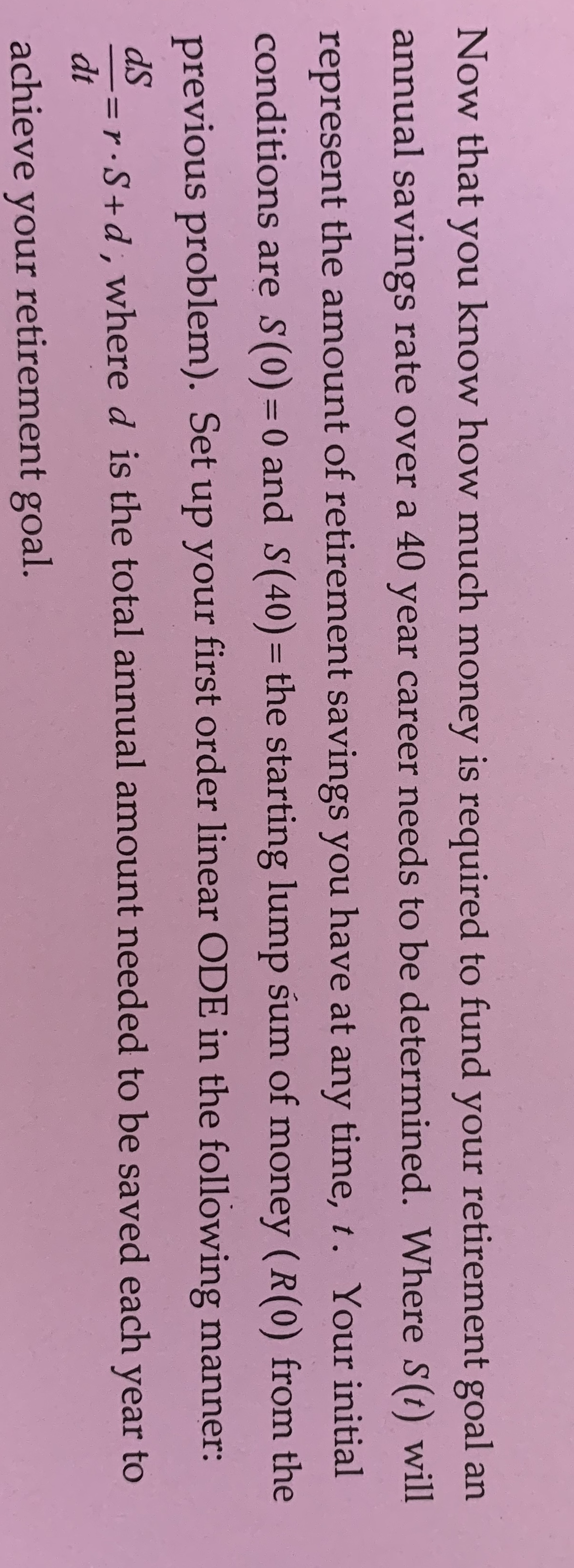

Upon landing your first job after college graduation a goal is set ... Retire with the ability to live on $5,000.00 monthly withdrawals from your retirement fund through the first 25 years of retirement. The answer to this first question will be finding the value of R(0) where R(t) is a solution to the first order differential equation you create and solve. R(0) will be the starting amount of your retirement nest egg. Note, R(25) = 0 after the last withdrawal. To compensate for inflation during your retirement years you will withdrawal monies at a rate proportional to the first year of withdrawals. Your withdrawals will increase by 2% each year; dW dt = 0.02W. . Set up your first order linear ODE in the following manner: dR = r . R - withdrawal. dtNow that you know how much money is required to fund your retirement goal an annual savings rate over a 40 year career needs to be determined. Where S(t) will represent the amount of retirement savings you have at any time, t. Your initial conditions are S(0) =0 and S(40) = the starting lump sum of money ( R(0) from the previous problem). Set up your first order linear ODE in the following manner: as dt =r . S+d, where d is the total annual amount needed to be saved each year to achieve your retirement goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts