Question: SETTING UP THE SUBSIDIARY ABROAD: PROBLEM NO . 1 Endalco Ltd . ( EL ) of India is planning to set up a subsidiary in

SETTING UP THE SUBSIDIARY ABROAD:

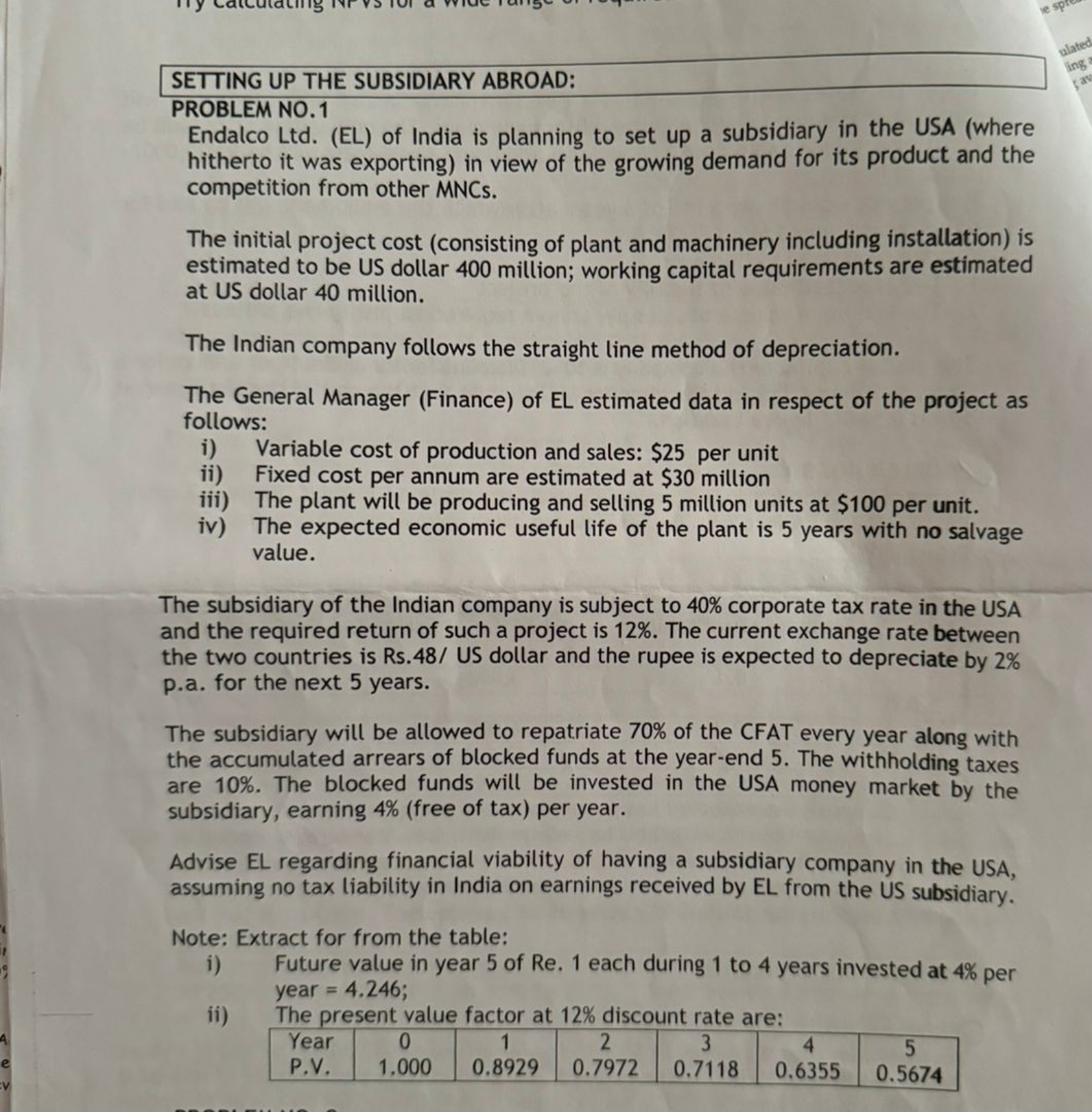

PROBLEM NO

Endalco LtdEL of India is planning to set up a subsidiary in the USA where

hitherto it was exporting in view of the growing demand for its product and the

competition from other MNCs

The initial project cost consisting of plant and machinery including installation is

estimated to be US dollar million; working capital requirements are estimated

at US dollar million.

The Indian company follows the straight line method of depreciation.

The General Manager Finance of EL estimated data in respect of the project as

follows:

i Variable cost of production and sales: $ per unit

ii Fixed cost per annum are estimated at $ million

iii The plant will be producing and selling million units at $ per unit.

iv The expected economic useful life of the plant is years with no salvage

value.

The subsidiary of the Indian company is subject to corporate tax rate in the USA

and the required return of such a project is The current exchange rate between

the two countries is Rs US dollar and the rupee is expected to depreciate by

pa for the next years.

The subsidiary will be allowed to repatriate of the CFAT every year along with

the accumulated arrears of blocked funds at the yearend The withholding taxes

are The blocked funds will be invested in the USA money market by the

subsidiary, earning free of tax per year.

Advise EL regarding financial viability of having a subsidiary company in the USA,

assuming no tax liability in India on earnings received by EL from the US subsidiary.

Note: Extract for from the table:

i Future value in year of Re each during to years invested at per

year

ii The present value factor at discount rate are:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock