Question: Setup: Baker Coep. has several new projects that look attractive, but some are riskier than the firm's past projects. Baker has received a major inflow

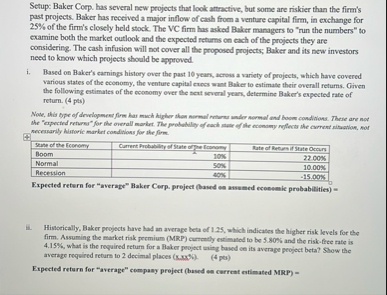

Setup: Baker Coep. has several new projects that look attractive, but some are riskier than the firm's past projects. Baker has received a major inflow of cash from a venture capital firm, in exchange for of the firm's closely held stock. The VC firm has asked Baker managers to "run the numbers" to examine both the market outlook and the expected returns on each of the projects they are considering. The cash infusion will not cover all the proposed projects; Baker and its new investors need to know which projects should be approved.

i Based on Baker's earnings history over the past years, across a variety of projects, which have covered various states of the economy, the venture capital execs want Baker to estimate their everall returns. Given the following estimates of the economy over the seat several years, determine Baker's expected rate of return. pts necessarily Alstoric market condivious for ate firm.

tableSeste of the Economy,Carrent Frehabitity of State of Tee Reanomery,Bate of Benamis State OccursBoomNormalRecestion

Expected retern for "average" Baker Cerp. preject based ea assumed ecosomic probabilities

ii Hinterically, Baker projects have had an average beta of which indicates the higher risk levels for the firm. Assuming the market risk permium MRP currently estimated to be and the riskfree rate is what is the required return for a Baker pooject with hased ce its average project beta? Show the average required return to decimal places

pts

Expected return for "average" company project based ea cerreat estimated MRP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock