Question: On January 1, 2019, Metco Inc. reported 290,000 shares of $4 par value common stock as being issued and outstanding On March 24, 2019,

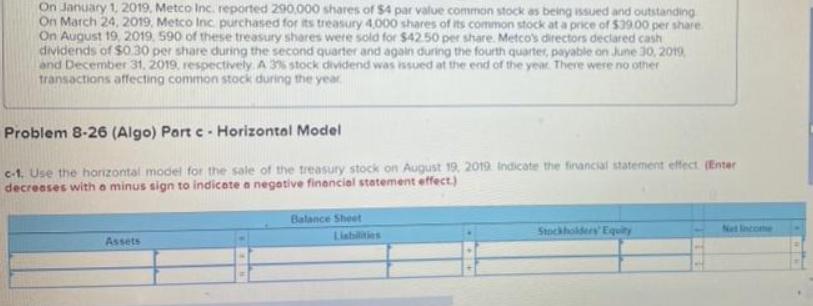

On January 1, 2019, Metco Inc. reported 290,000 shares of $4 par value common stock as being issued and outstanding On March 24, 2019, Metco Inc purchased for its treasury 4,000 shares of its common stock at a price of $3900 per share On August 19, 2019. 590 of these treasury shares were sold for $42.50 per share. Metco's directors declared cash dividends of $0.30 per share during the second quarter and again during the fourth quarter, payable on June 30, 2019 and December 31, 2019. respectively A 3% stock dividend was issued at the end of the year. There were no other transactions affecting common stock during the year Problem 8-26 (Algo) Part c - Horizontal Model c-1. Use the horizontal model for the sale of the treasury stock on August 19, 2019 Indicate the financial statement effect (Enter decreeses with o minus sign to indicate a negative finencial statement effect.) Balance Sheet Stockholdery Equity Nat lincome Lisbilities Assets

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

To address this question we need to analyze the sale of treasury stock on August 19 2019 using the h... View full answer

Get step-by-step solutions from verified subject matter experts