Question: Several years ago, your client, Brooks Robinson, started an office cleaning service. His business was very successful, owing much to his legacy as the greatest

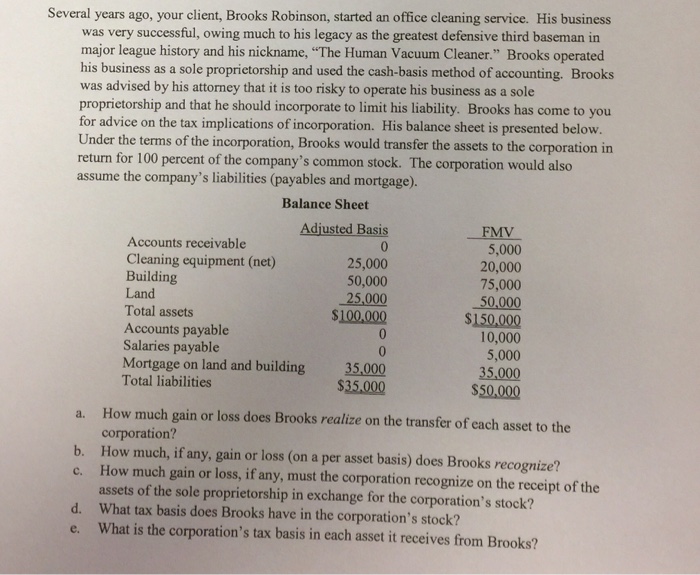

Several years ago, your client, Brooks Robinson, started an office cleaning service. His business was very successful, owing much to his legacy as the greatest defensive third baseman in major league history and his nickname, "The Human Vacuum Cleaner." Brooks operated his business as a sole proprietorship and used the cash-basis method of accounting. Brooks was advised by his attorney that it is too risky to operate his business as a sole proprietorship and that he should incorporate to limit his liability. Brooks has come to you for advice on the tax implications of incorporation. His balance sheet is presented below. Under the terms of the incorporation, Brooks would transfer the assets to the corporation i return for 100 percent of the company's common stock. The corporation would also assume the company's liabilities (payables and mortgage). Balance Sheet IV 5,000 20,000 75,000 50,000 $150,000 10,000 5,000 35,000 $50,000 Adjusted Basis Accounts receivable Cleaning equipment (net) Building Land Total assets Accounts payable Salaries payable Mortgage on land and building Total liabilities 25,000 50,000 35,000 $35,000 How much gain or loss does Brooks realize on the transfer of each asset to the corporation? How much, if any, gain or loss (on a per asset basis) does Brooks recognize? How much gain or loss, if any, must the corporation recognize on the receipt of the assets of the sole proprietorship in exchange for the corporation's stock? What tax basis does Brooks have in the corporation's stock? What is the corporation's tax basis in each asset it receives from Brooks? a. b. c. d. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts