Question: Shamrock Inc. issued $ 5 , 6 2 5 , 0 0 0 of convertible 5 - year bonds on July 1 , 2

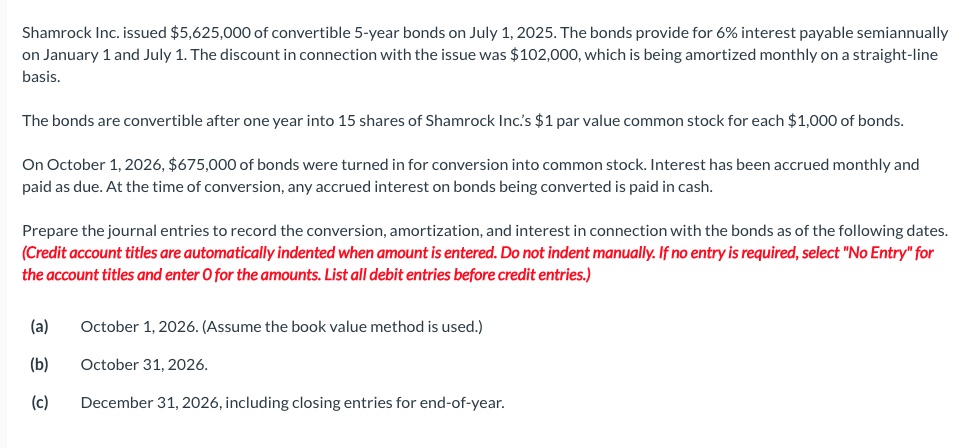

Shamrock Inc. issued $ of convertible year bonds on July The bonds provide for interest payable semiannually on January and July The discount in connection with the issue was $ which is being amortized monthly on a straightline basis. The bonds are convertible after one year into shares of Shamrock Inc.s $ par value common stock for each $ of bonds. On October $ of bonds were turned in for conversion into common stock. Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries.a October Assume the book value method is used.b October c December including closing entries for endofyear. Dec.

c

Discount on Bonds Payable

To record amortization of discount on bonds

Dec.

To record accrual of interest payable on bonds

Dec.

To close expense accounta

Oct.

Discount on Bonds Payable

Common Stock

Paidin Capital in Excess of Par Common Stock

To record conversion of bonds to common stock

Oct.

To record payment of interest due on converted bonds

Oct.

b

Discount on Bonds Payable

To record amortization of discount on bonds

Oct.

To record accrual of interest payable on bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock