Question: Shekha Bhalla completed his college program in December 2016 with a $11,600 Canada Student Loan. He selected the fixed rate option (prime +2.5%) and agreed

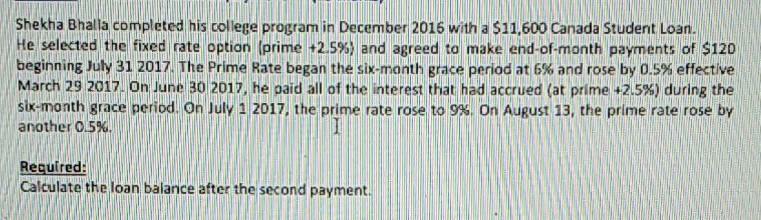

Shekha Bhalla completed his college program in December 2016 with a $11,600 Canada Student Loan. He selected the fixed rate option (prime +2.5%) and agreed to make end-of-month payments of $120 beginning July 31 2017. The Prime Rate began the six-month grace period at 6% and rose by 0.5% effective March 29 2017. On June 30 2017, he paid all of the interest that had accrued (at prime +2.5%) during the six-month grace period. On July 1 2017, the prime rate rose to 9%. On August 13, the prime rate rose by another 0.5% Required: Calculate the loan balance after the second payment. Shekha Bhalla completed his college program in December 2016 with a $11,600 Canada Student Loan. He selected the fixed rate option (prime +2.5%) and agreed to make end-of-month payments of $120 beginning July 31 2017. The Prime Rate began the six-month grace period at 6% and rose by 0.5% effective March 29 2017. On June 30 2017, he paid all of the interest that had accrued (at prime +2.5%) during the six-month grace period. On July 1 2017, the prime rate rose to 9%. On August 13, the prime rate rose by another 0.5% Required: Calculate the loan balance after the second payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts