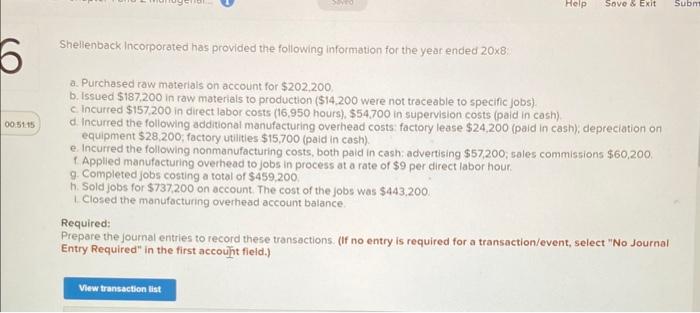

Question: Shellenback Incorporated has provided the following information for the year ended 208 : a. Purchased raw materials on account for $202,200 b. Issued $187,200 in

Shellenback Incorporated has provided the following information for the year ended 208 : a. Purchased raw materials on account for $202,200 b. Issued $187,200 in raw materials to production ( $14,200 were not traceable to specific jobs) C. Incurred $157,200 in direct labor costs (16,950 hours), $54,700 in supervision costs (paid in cash). d. Incurred the following additional manufacturing overhead costs: factory lease $24,200 (paid in cash), depreciation on equipment $28,200, factory utiities $15,700 (paid in cash) e. Incurred the following nonmanufacturing costs, both paid in cash: advertising $57,200;5ales commissions $60,200. f. Applied manufacturing overhead to jobs in process at a rate of $9 per direct labor hour. 9. Completed jobs costing a total of $459,200 h. Sold jobs for $737,200 on account. The cost of the jobs was $443.200 1. Closed the manufacturing overhead account balance. Required: Prepare the journal entries to record these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first accouht fieid.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts