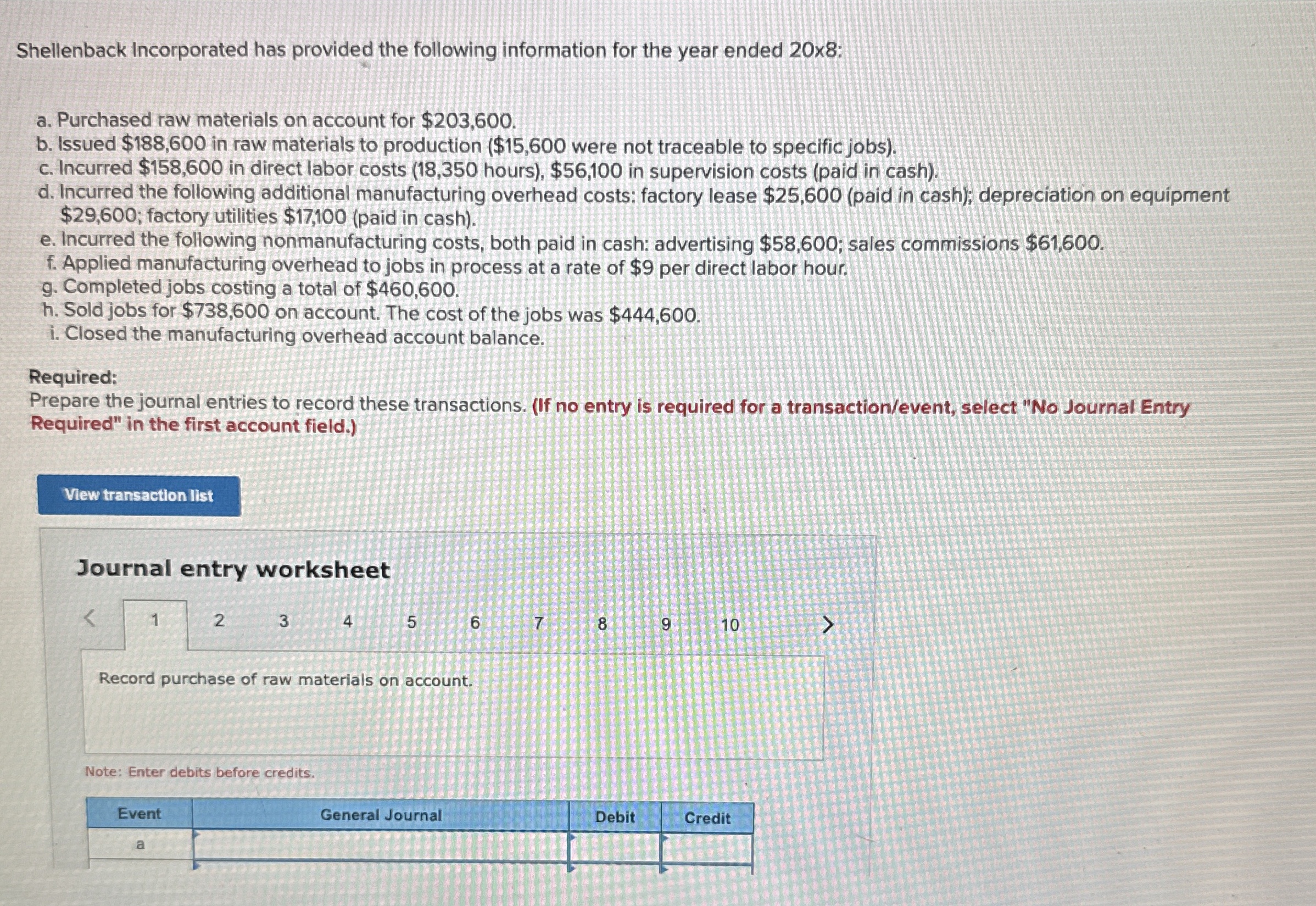

Question: Shellenback Incorporated has provided the following information for the year ended 2 0 x 8 : a . Purchased raw materials on account for $

Shellenback Incorporated has provided the following information for the year ended x:

a Purchased raw materials on account for $

b Issued $ in raw materials to production $ were not traceable to specific jobs

c Incurred $ in direct labor costs hours $ in supervision costs paid in cash

d Incurred the following additional manufacturing overhead costs: factory lease $paid in cash; depreciation on equipment $; factory utilities $paid in cash

e Incurred the following nonmanufacturing costs, both paid in cash: advertising $; sales commissions $

f Applied manufacturing overhead to jobs in process at a rate of $ per direct labor hour.

g Completed jobs costing a total of $

h Sold jobs for $ on account. The cost of the jobs was $

i Closed the manufacturing overhead account balance.

Required:

Prepare the journal entries to record these transactions. If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

Journal entry worksheet

Record purchase of raw materials on account.

Note: Enter debits before credits.

tableEventGeneral Journal,Debit,Credita

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock