Question: Sheraton Chapter 10: Project Cash Flow Estimation and Risk Analysis END-OF-CHAPTER PROBLEMS 10.1 Great Lakes Clinic has been asked to provide exclusive healthcare services for

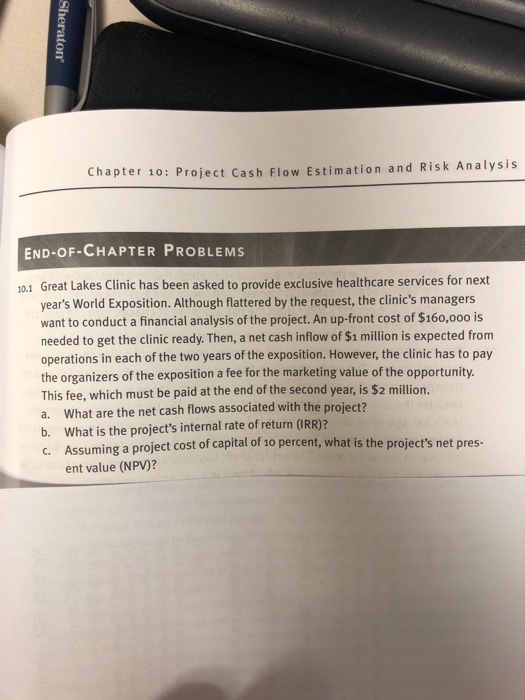

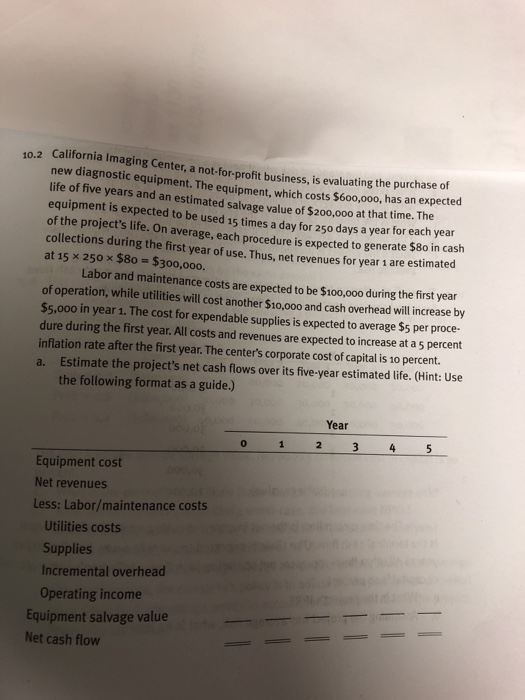

Sheraton Chapter 10: Project Cash Flow Estimation and Risk Analysis END-OF-CHAPTER PROBLEMS 10.1 Great Lakes Clinic has been asked to provide exclusive healthcare services for next year's World Exposition. Although flattered by the request, the clinic's managers want to conduct a financial analysis of the project. An up-front cost of $160,000 is needed to get the clinic ready. Then, a net cash inflow of $1 million is expected from operations in each of the two years of the exposition. However, the clinic has to pay the organizers of the exposition a fee for the marketing value of the opportunity. This fee, which must be paid at the end of the second year, is $2 million. a. What are the net cash flows associated with the project? b. What is the project's internal rate of return (IRR)? C. Assuming a project cost of capital of 10 percent, what is the project's net pres. ent value (NPV)? 10.2 California Imaging Center, enter, a not-for-profit business, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $600,000, has an expected life of five years and an estimated salvage value of $200,000 at that time. The equipment is expected to be used 15 times a day for 250 days a year for each year of the project's life. On average in average, each procedure is expected to generate $80 in cash collections during the first year of use. Thus, net revenues for year 1 are estimated at 15 x 250 x $80 = $300,000. Labor and maintenance costs are expected to be $100.000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in year 1. The cost for expendable supplies is expected to average $5 per proce- dure during the first year. All costs and revenues are expected to increase at a 5 percent inflation rate after the first year. The center's corporate cost of capital is 10 percent. a. Estimate the project's net cash flows over its five-year estimated life. (Hint: Use the following format as a guide.) 0 Year 2 3 1 4 5 Equipment cost Net revenues Less: Labor/maintenance costs Utilities costs Supplies Incremental overhead Operating income Equipment salvage value Net cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts