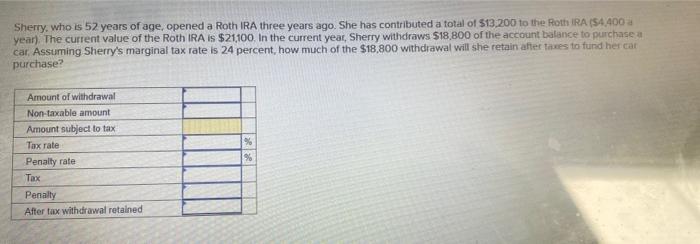

Question: Sherry, who is 52 years of age, opened a Roth IRA three years ago. She has contributed a total of $13,200 to the Roth iRA

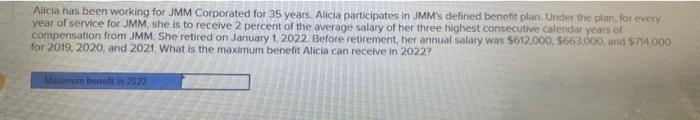

Sherry, who is 52 years of age, opened a Roth IRA three years ago. She has contributed a total of $13,200 to the Roth iRA (S4,400 a year). The current value of the Roth IRA is $21,100. In the current year, Sherry withdraws $18,800 of the account batance to purchase a car. Assuming Sherry's marginal tax rate is 24 percent, how much of the $18,800 withdrawal will she retain aftet taxes to fund her cat purchase? Alicia has been working for JMM Corporated for 35 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2022. Before retirement, her annual salary was $612,000,5663,000, and $714,000 for 2019, 2020, and 2021. What is the maximum benefit Alicia can receive in 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts