Question: Sherry, who is 52 years of age, opened a Roth IRA three years ago. She has contributed a total of $12,000 to the Roth IRA

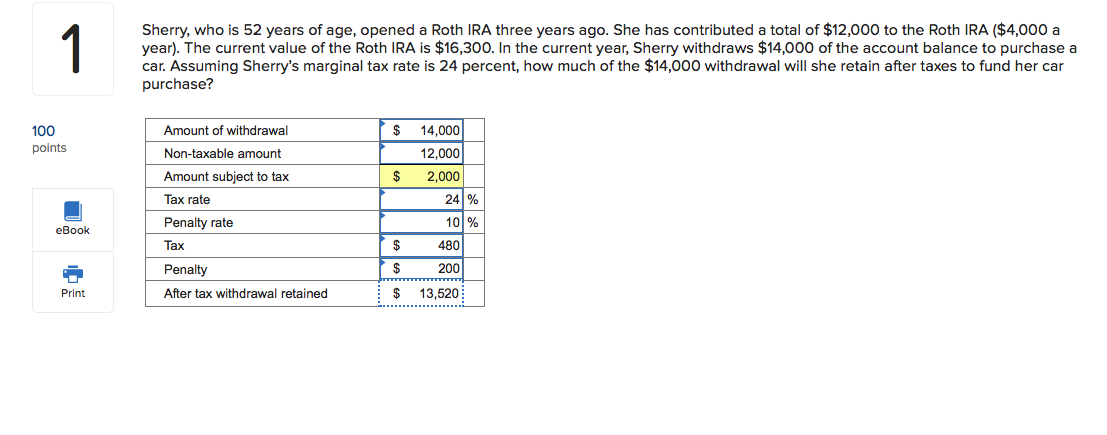

Sherry, who is 52 years of age, opened a Roth IRA three years ago. She has contributed a total of $12,000 to the Roth IRA ($4,000 a year). The current value of the Roth IRA is $16,300. In the current year, Sherry withdraws $14,000 of the account balance to purchase a car. Assuming Sherry's marginal tax rate is 24 percent, how much of the $14,000 withdrawal will she retain after taxes to fund her car purchase? $ 100 points 14,000 12,000 Amount of withdrawal Non-taxable amount Amount subject to tax Tax rate $ 2,000 24% 101% eBook $ 480 Penalty rate Tax Penalty After tax withdrawal retained $ 200 Print $ 13,520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts