Question: Short answer questions. Circle the correct answer and briefly explain (one sentence is enough). 5. T/F: The partial derivative of the call option value to

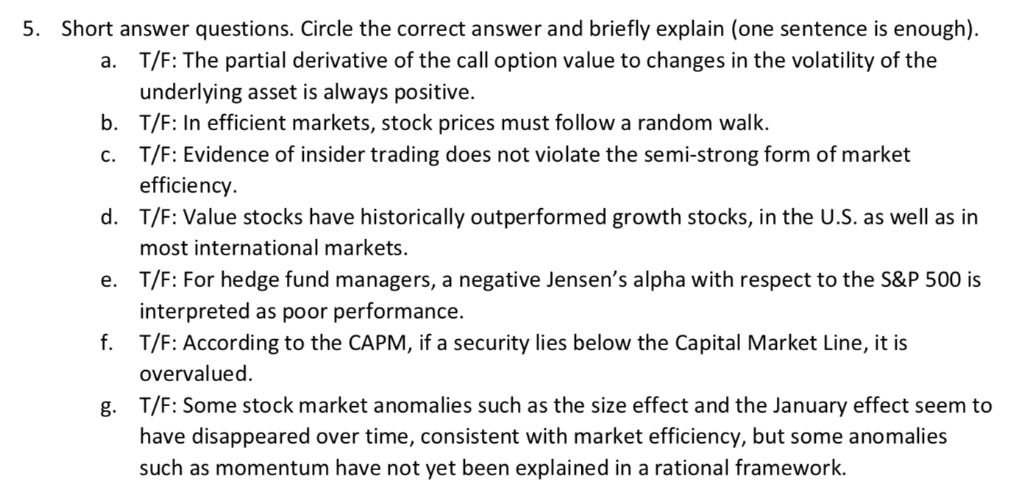

Short answer questions. Circle the correct answer and briefly explain (one sentence is enough). 5. T/F: The partial derivative of the call option value to changes in the volatility of the underlying asset is always positive. T/F: In efficient markets, stock prices must follow a random walk. T/F: Evidence of insider trading does not violate the semi-strong form of market efficiency a. b. c. d. T/F: Value stocks have historically outperformed growth stocks, in the U.S. as well as in e. T/F: For hedge fund managers, a negative Jensen's alpha with respect to the S&P 500 is f. T/F: According to the CAPM, if a security lies below the Capital Market Line, it is g. T/F: Some stock market anomalies such as the size effect and the January effect seem to most international markets. interpreted as poor performance. overvalued. have disappeared over time, consistent with market efficiency, but some anomalies such as momentum have not yet been explained in a rational framework. Short answer questions. Circle the correct answer and briefly explain (one sentence is enough). 5. T/F: The partial derivative of the call option value to changes in the volatility of the underlying asset is always positive. T/F: In efficient markets, stock prices must follow a random walk. T/F: Evidence of insider trading does not violate the semi-strong form of market efficiency a. b. c. d. T/F: Value stocks have historically outperformed growth stocks, in the U.S. as well as in e. T/F: For hedge fund managers, a negative Jensen's alpha with respect to the S&P 500 is f. T/F: According to the CAPM, if a security lies below the Capital Market Line, it is g. T/F: Some stock market anomalies such as the size effect and the January effect seem to most international markets. interpreted as poor performance. overvalued. have disappeared over time, consistent with market efficiency, but some anomalies such as momentum have not yet been explained in a rational framework

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts