Question: SHORT ANSWER QUESTIONS (Enter your answers on the ANSWER SHEET). 7) Briefly explain what is the Payback period. 4pts 4pts 8) Briefly explain what

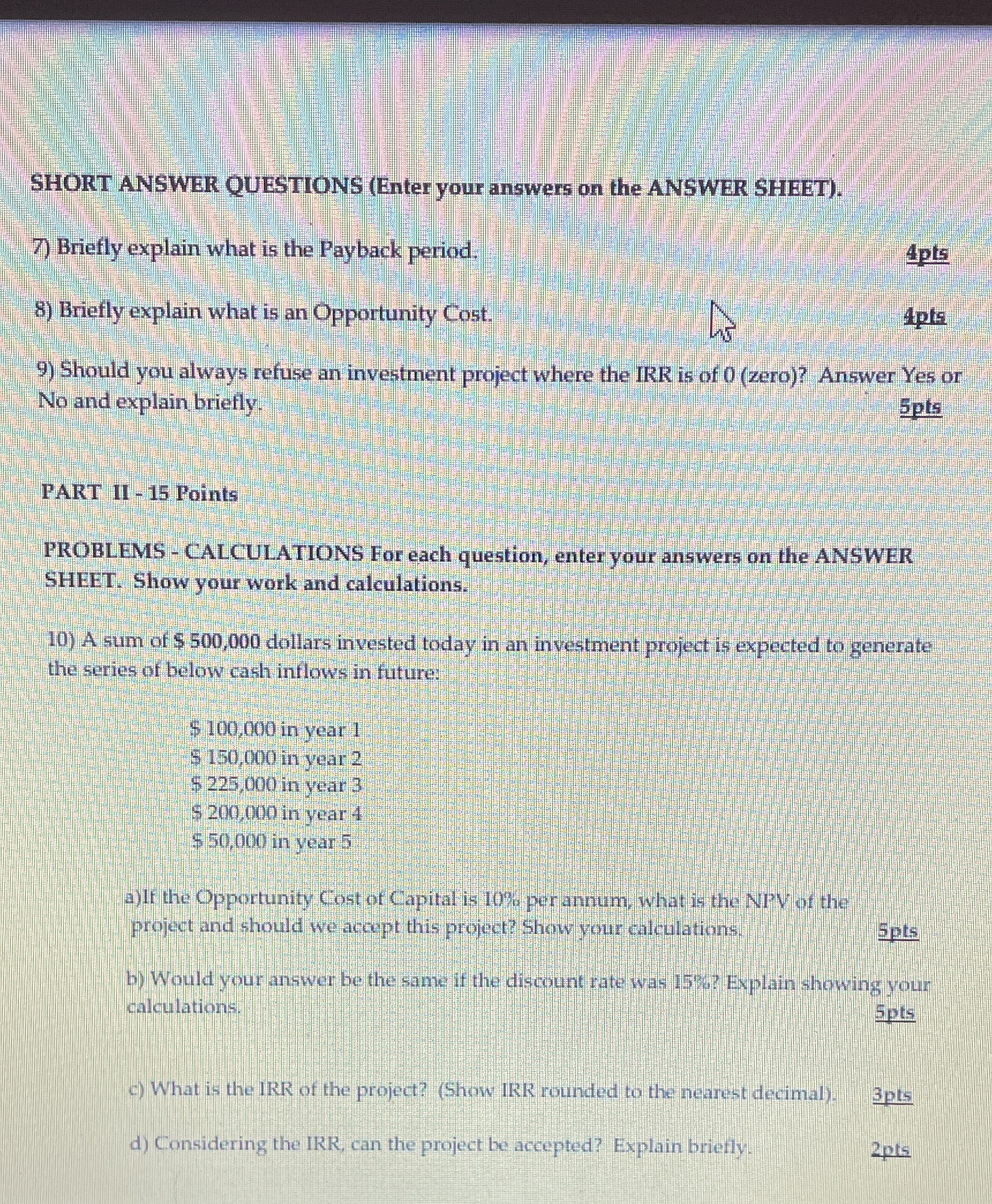

SHORT ANSWER QUESTIONS (Enter your answers on the ANSWER SHEET). 7) Briefly explain what is the Payback period. 4pts 4pts 8) Briefly explain what is an Opportunity Cost. 9) Should you always refuse an investment project where the IRR is of 0 (zero)? Answer Yes or No and explain briefly. 5pts PART II-15 Points PROBLEMS - CALCULATIONS For each question, enter your answers on the ANSWER SHEET. Show your work and calculations. 10) A sum of $ 500,000 dollars invested today in an investment project is expected to generate the series of below cash inflows in future: $100,000 in year 1 $ 150,000 in year 2 $225,000 in year 3 $ 200,000 in year 4 $50,000 in year 5 a)lt the Opportunity Cost of Capital is 10% per annum, what is the NPV of the project and should we accept this project? Show your calculations. 5pts b) Would your answer be the same if the discount rate was 15%? Explain showing your calculations. 5pts c) What is the IRR of the project? (Show IRR rounded to the nearest decimal). 3pts d) Considering the IRR, can the project be accepted? Explain briefly. 2pts

Step by Step Solution

There are 3 Steps involved in it

ANSWER SHEET 7 Briefly explain what is the Payback period The payback period is the number of years ... View full answer

Get step-by-step solutions from verified subject matter experts