Question: short answer : word or phrase to complete 28) 28) The CEO of Flying Carpet Transport, Inc recently told financial analysts that he expects the

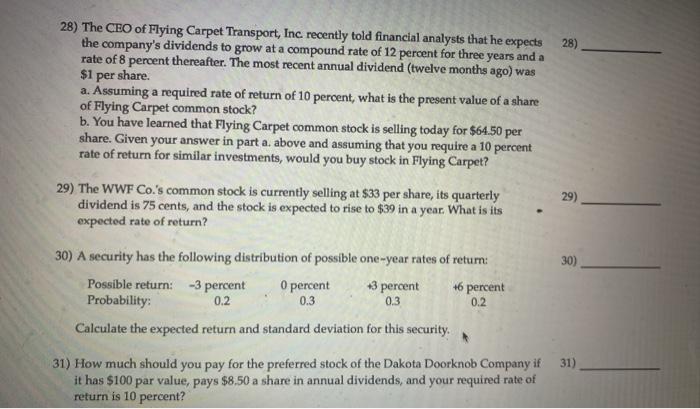

28) 28) The CEO of Flying Carpet Transport, Inc recently told financial analysts that he expects the company's dividends to grow at a compound rate of 12 percent for three years and a rate of 8 percent thereafter. The most recent annual dividend (twelve months ago) was $1 per share. a. Assuming a required rate of return of 10 percent, what is the present value of a share of Flying Carpet common stock? b. You have learned that Flying Carpet common stock is selling today for $64.50 per share. Given your answer in part a. above and assuming that you require a 10 percent rate of return for similar investments, would you buy stock in Flying Carpet? 29) The WWF Co.'s common stock is currently selling at $33 per share, its quarterly dividend is 75 cents, and the stock is expected to rise to $39 in a year. What is its expected rate of return? 29) 30) 0.3 0.2 30) A security has the following distribution of possible one-year rates of return: Possible return: -3 percent O percent +3 percent 46 percent Probability: 0.2 0.3 Calculate the expected return and standard deviation for this security. 31) How much should you pay for the preferred stock of the Dakota Doorknob Company if it has $100 par value, pays $8.50 a share in annual dividends, and your required rate of return is 10 percent? 31)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts