Question: Short Computations (4 points each) General Instructions: The financial statements for CAT and CRE are all in millions. Any of your answers that are to

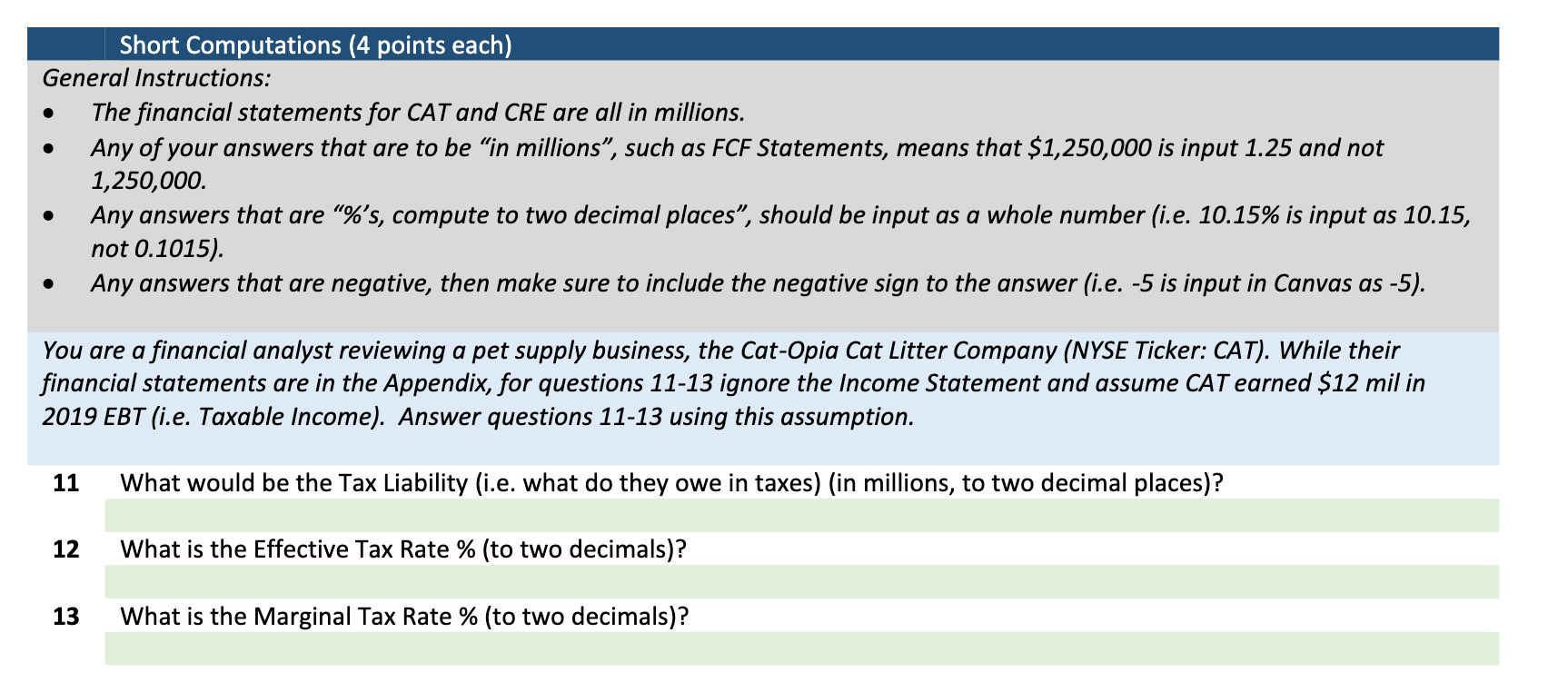

Short Computations (4 points each) General Instructions: The financial statements for CAT and CRE are all in millions. Any of your answers that are to be in millions, such as FCF Statements, means that $1,250,000 is input 1.25 and not 1,250,000. Any answers that are %'s, compute to two decimal places, should be input as a whole number (i.e. 10.15% is input as 10.15, not 0.1015). Any answers that are negative, then make sure to include the negative sign to the answer (i.e. -5 is input in Canvas as -5). . You are a financial analyst reviewing a pet supply business, the Cat-Opia Cat Litter Company (NYSE Ticker: CAT). While their financial statements are in the Appendix, for questions 11-13 ignore the Income Statement and assume CAT earned $12 mil in 2019 EBT (i.e. Taxable income). Answer questions 11-13 using this assumption. 11 What would be the Tax Liability (i.e. what do they owe in taxes) (in millions, to two decimal places)? 12 What is the Effective Tax Rate % (to two decimals)? 13 What is the Marginal Tax Rate % (to two decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts