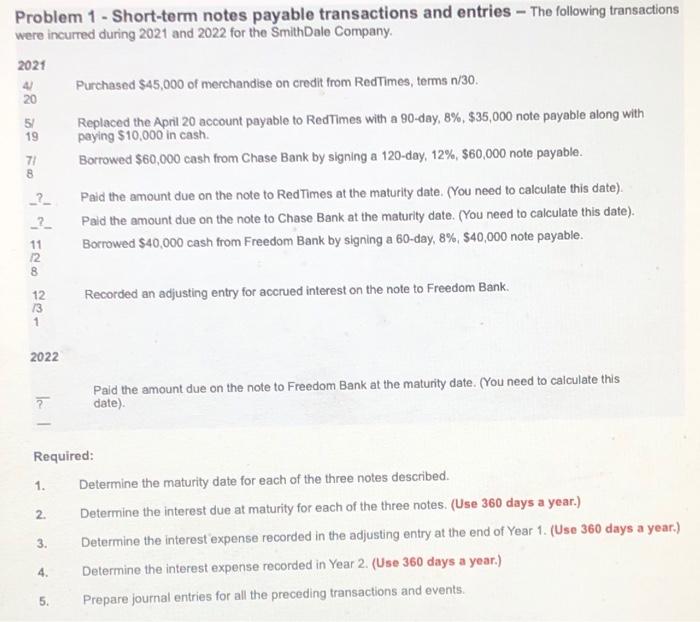

Question: Short Term Notes Payable transactions and entries Problem 1 - Short-term notes payable transactions and entries - The following transactions were incurred during 2021 and

Problem 1 - Short-term notes payable transactions and entries - The following transactions were incurred during 2021 and 2022 for the SmithDale Company 2021 Purchased $45,000 of merchandise on credit from RedTimes, terms n/30 20 5/ 19 71 8 Replaced the April 20 account payable to RedTimes with a 90-day, 8%, $35,000 note payable along with paying $10,000 in cash. Borrowed $60,000 cash from Chase Bank by signing a 120-day, 12%, $60,000 note payable. Paid the amount due on the note to Red Times at the maturity date. (You need to calculate this date). Pald the amount due on the note to Chase Bank at the maturity date. (You need to calculate this date). Borrowed $40,000 cash from Freedom Bank by signing a 60-day, 8%, $40,000 note payable. _? __ 11 12 8 Recorded an adjusting entry for accrued interest on the note to Freedom Bank 12 13 1 2022 Pald the amount due on the note to Freedom Bank at the maturity date. (You need to calculate this date). 2 1. 2. Required: Determine the maturity date for each of the three notes described. Determine the interest due at maturity for each of the three notes. (Use 360 days a year.) Determine the interest expense recorded in the adjusting entry at the end of Year 1. (Use 360 days a year.) Determine the interest expense recorded in Year 2. (Use 360 days a year.) Prepare journal entries for all the preceding transactions and events. 3. 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts