Question: Should you undertake the project? How much debt should you hold at each point in time to maintain a debt-to-value ratio of 30%? You are

Should you undertake the project? How much debt should you hold at each point in time to maintain a debt-to-value ratio of 30%?

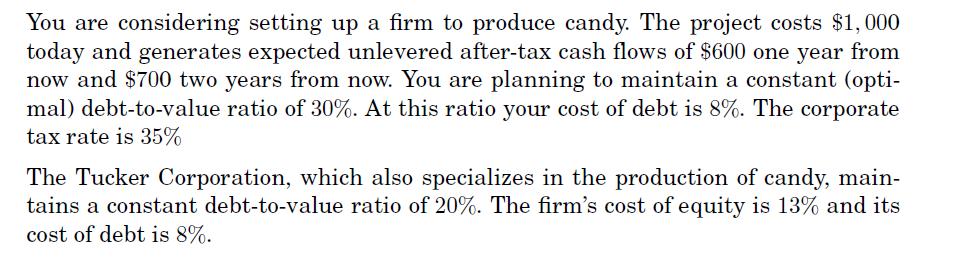

You are considering setting up a firm to produce candy. The project costs $1,000 today and generates expected unlevered after-tax cash flows of $600 one year from now and $700 two years from now. You are planning to maintain a constant (opti- mal) debt-to-value ratio of 30%. At this ratio your cost of debt is 8%. The corporate tax rate is 35% The Tucker Corporation, which also specializes in the production of candy, main- tains a constant debt-to-value ratio of 20%. The firm's cost of equity is 13% and its cost of debt is 8%.

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

To determine whether you should undertake the project we need to calculate the projects net present ... View full answer

Get step-by-step solutions from verified subject matter experts