Question: show all steps please and net operating asset tomover LO6, hny in these ratios for each company 7E4-33. dstrom Inc. (JWN) L Brands Inc. (LB)

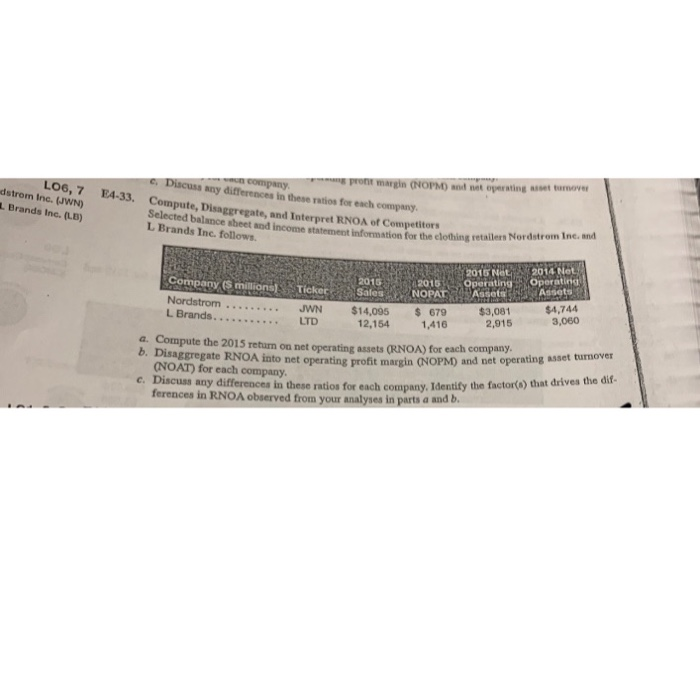

and net operating asset tomover LO6, hny in these ratios for each company 7E4-33. dstrom Inc. (JWN) L Brands Inc. (LB) Compute, Disaggregate, and Interpret RNOA of Competitors Selected balance aheet L Brands Inc. follows. beet and income statement information for the clothing retailers Nor dstrom Ine. and 01N2014 Not 2016 01OperatingOperating Company (S millionsTickeSalesNOPATAsset Nordstrom JWN $14,095 679 $4,744 3,060 $3,081 2,915 12,154 1,416 a. Compute the 2015 return on net operating assets (RNOA) for each company b. Disaggregate NOSTgate RNOA into net operating profit margin (NOPM) and net operating asset turnover for each company c. Discuss any differences in these ratios for each company, Identify the factor() that drives the ferences in RNOA observed yses in parts a and b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts