Question: Show all work. Highlight final answer. DO NOT answer questions if you cannot answer them all. 19. OpenSeas, Inc. is evaluating the purchase of a

Show all work. Highlight final answer. DO NOT answer questions if you cannot answer them all.

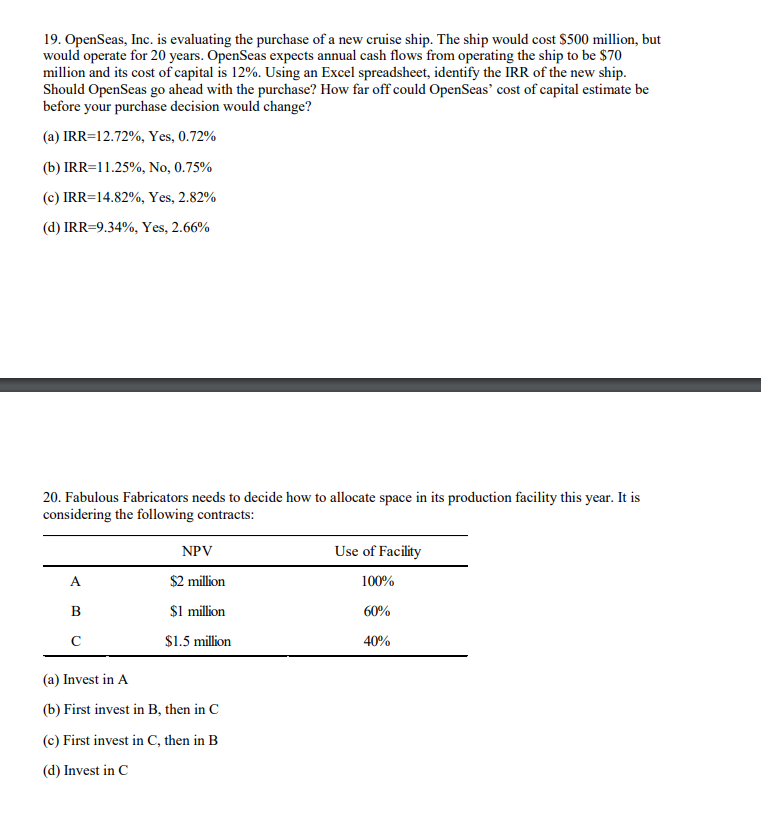

19. OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost S500 million, but would operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $70 million and its cost of capital is 12%. Using an Excel spreadsheet, identify the IRR of the new ship Should OpenSeas go ahead with the purchase? How far off could OpenSeas' cost of capital estimate be before your purchase decision would change? (a) IRR-12.72%, Yes, 0.72% (b) IRR-1 1.25%, No, 0.75% (c) IRR-14.82%, Yes, 2.82% (d) IRR-9.34%, Yes, 2.66% 20. Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts NPV $2 million $1 million $1.5 million Use of Facility 100% 60% 40% (a) Invest in A (b) First invest in B, then in C (c) First invest in C, then in B (d) Invest in C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts