Question: Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order

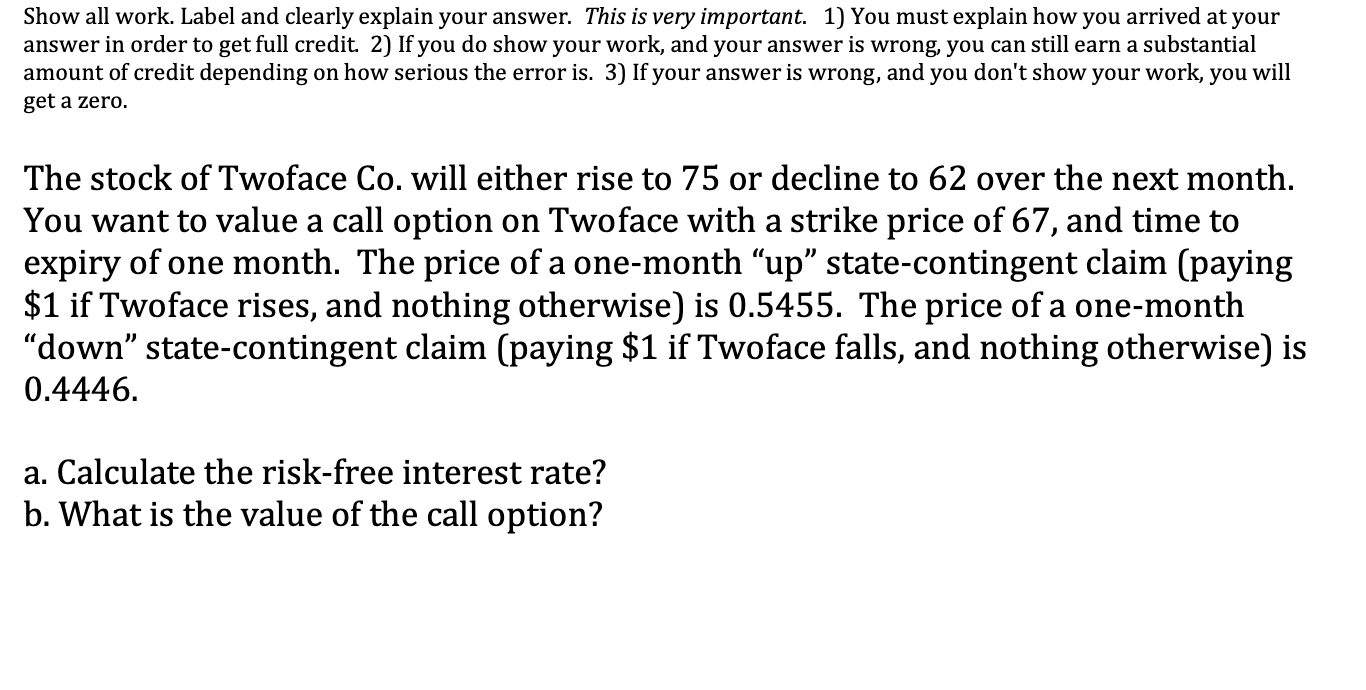

Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order to get full credit. 2) If you do show your work, and your answer is wrong, you can still earn a substantial amount of credit depending on how serious the error is. 3) If your answer is wrong, and you don't show your work, you will get a zero. a a The stock of Twoface Co. will either rise to 75 or decline to 62 over the next month. You want to value a call option on Twoface with a strike price of 67, and time to expiry of one month. The price of a one-month up state-contingent claim (paying $1 if Twoface rises, and nothing otherwise) is 0.5455. The price of a one-month down state-contingent claim (paying $1 if Twoface falls, and nothing otherwise) is 0.4446. a. Calculate the risk-free interest rate? b. What is the value of the call option? Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order to get full credit. 2) If you do show your work, and your answer is wrong, you can still earn a substantial amount of credit depending on how serious the error is. 3) If your answer is wrong, and you don't show your work, you will get a zero. a a The stock of Twoface Co. will either rise to 75 or decline to 62 over the next month. You want to value a call option on Twoface with a strike price of 67, and time to expiry of one month. The price of a one-month up state-contingent claim (paying $1 if Twoface rises, and nothing otherwise) is 0.5455. The price of a one-month down state-contingent claim (paying $1 if Twoface falls, and nothing otherwise) is 0.4446. a. Calculate the risk-free interest rate? b. What is the value of the call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts