Question: Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order

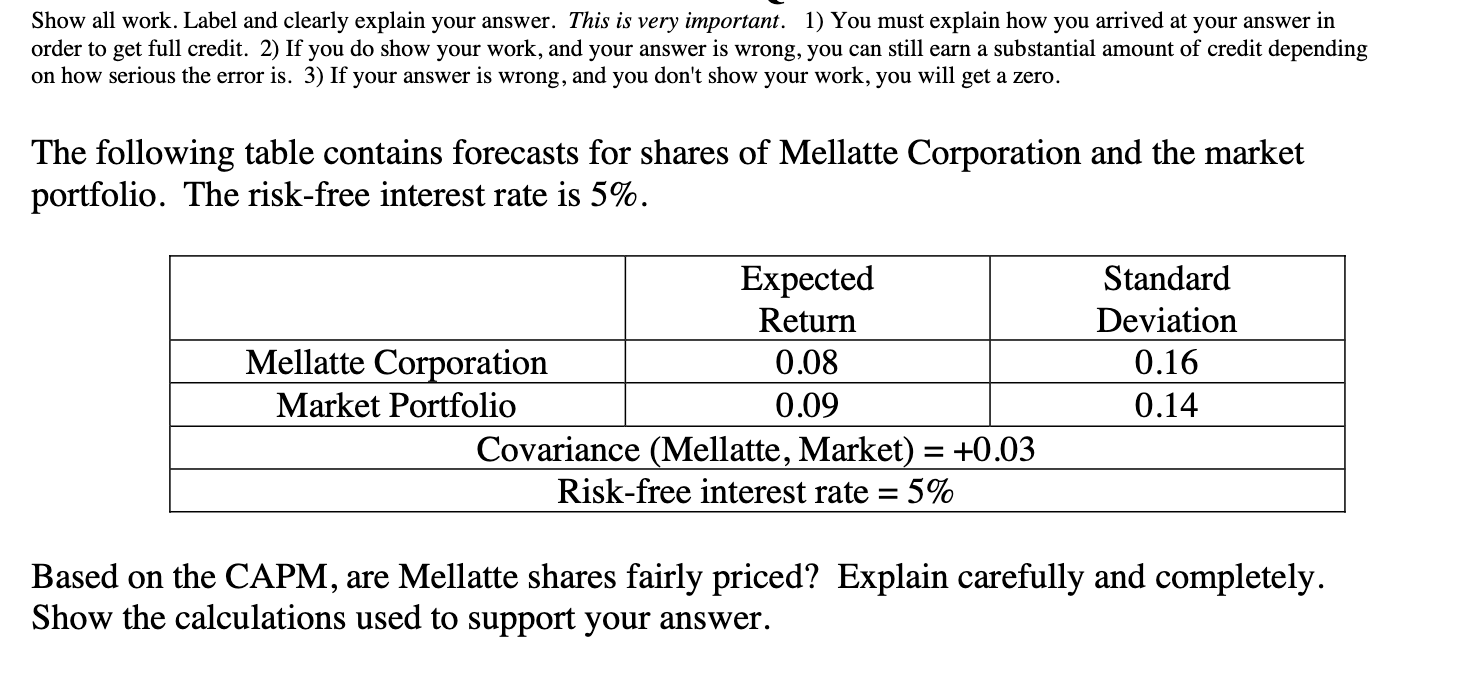

Show all work. Label and clearly explain your answer. This is very important. 1) You must explain how you arrived at your answer in order to get full credit. 2) If you do show your work, and your answer is wrong, you can still earn a substantial amount of credit depending on how serious the error is. 3) If your answer is wrong, and you don't show your work, you will get a zero. The following table contains forecasts for shares of Mellatte Corporation and the market portfolio. The risk-free interest rate is 5%. Expected Return Mellatte Corporation 0.08 Market Portfolio 0.09 Covariance (Mellatte, Market) = +0.03 Risk-free interest rate = 5% Standard Deviation 0.16 0.14 = Based on the CAPM, are Mellatte shares fairly priced? Explain carefully and completely. Show the calculations used to support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts