Question: Show all work please. 4. What is the basis for the march gold futures contract? 5. What is nadia's net price paid per troy ounce?

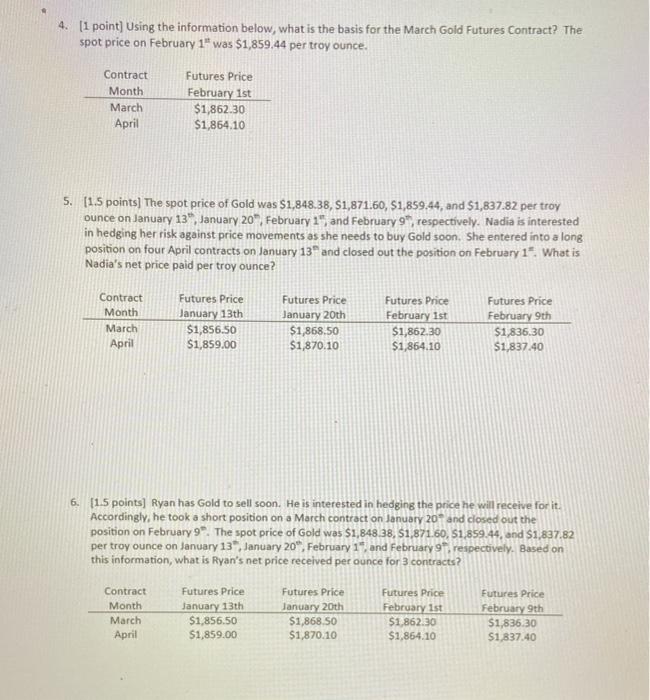

4. (1 point) Using the information below, what is the basis for the March Gold Futures Contract? The spot price on February 1" was $1,859.44 per troy ounce. Contract Month March April Futures Price February 1st $1,862.30 $1,864.10 5. (1.5 points) The spot price of Gold was $1,848.38, S1,871.50, 51,859.44, and $1,837.82 per troy ounce on January 13, January 20, February 14, and February 9, respectively. Nadia is interested in hedging her risk against price movements as she needs to buy Gold soon. She entered into a long position on four April contracts on January 13 and closed out the position on February 1". What is Nadia's net price paid per troy ounce? Contract Month March April Futures Price January 13th $1,856.50 $1,859.00 Futures Price January 20th $1,868.50 $1,870.10 Futures Price February 1st $1,862.30 $1,854.10 Futures Price February 9th $1,836.30 $1,837.40 6. [1.5 points) Ryan has Gold to sell soon. He is interested in hedging the price he will receive for it. Accordingly, he took a short position on a March contract on January 20* and dosed out the position on February 9" The spot price of Gold was $1,848.38, S1,871.60, S1,859.44, and $1,837.82 per troy ounce on January 13, January 20, February 17 and February 9, respectively. Based on this information, what is Ryan's net price received per ounce for 3 contracts? Contract Month March April Futures Price January 13th $1,856,50 $1,859.00 Futures Price January 20th $1,868.50 $1,870.10 Futures Price February 1st $1,862.30 $1,864.10 Futures Price February 9th $1,836.30 $1,837.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts