Question: What is ryans net price recieved per ounce for 3 contracts? 6. [1.5 points] Ryan has Gold to sell soon. He is interested in hedging

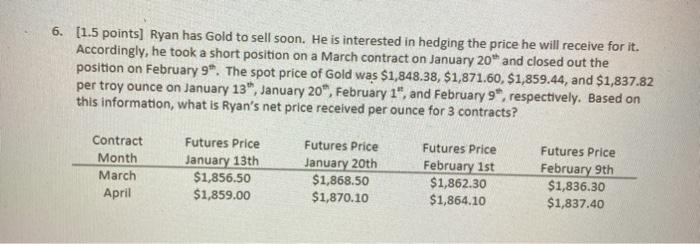

6. [1.5 points] Ryan has Gold to sell soon. He is interested in hedging the price he will receive for it. Accordingly, he took a short position on a March contract on January 20** and closed out the position on February 9". The spot price of Gold was $1,848.38, $1,871.60, $1,859.44, and $1,837.82 per troy ounce on January 13", January 20", February 1", and February 9*, respectively. Based on this information, what is Ryan's net price received per ounce for 3 contracts? Contract Month March April Futures Price January 13th $1,856.50 $1,859.00 Futures Price January 20th $1,868.50 $1,870.10 Futures Price February 1st $1,862.30 $1,864.10 Futures Price February 9th $1,836.30 $1,837.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts