Question: show all work please and all the steps without using excel. Instructions: Show all of your work for maximum credit. You may use a financial

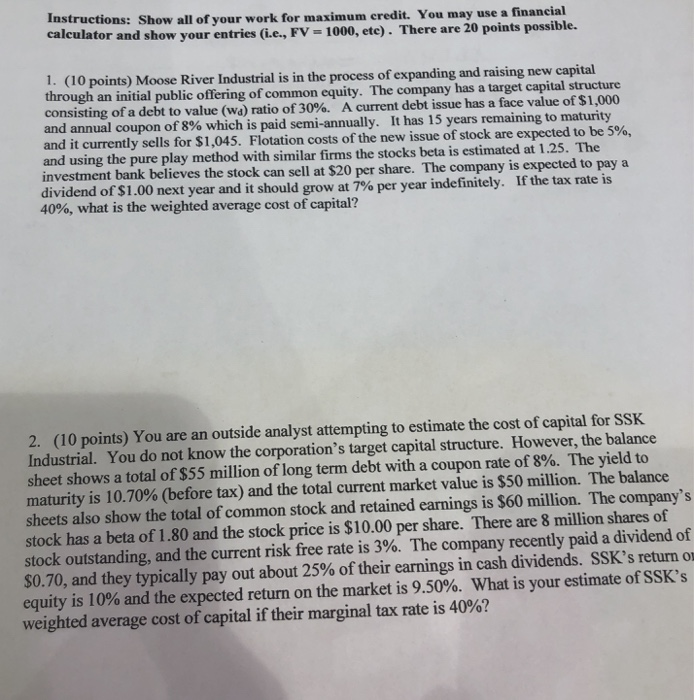

Instructions: Show all of your work for maximum credit. You may use a financial calculator and show your entries (i.e., FV = 1000, ete). There are 20 points possible. 1. (10 points) Moose River Industrial is in the process of expanding and raising new capital through an initial public offering of common equity. The company has a target capital structure consisting of a debt to value (wa) ratio of 30%. A current debt issue has a face value of $1,000 and annual coupon of 8% which is paid semi-annually. It has 15 years remaining to maturity and it currently sells for $1,045. Flotation costs of the new issue of stock are expected to be 5%, and using the pure play method with similar firms the stocks beta is estimated at 1.25. The investment bank believes the stock can sell at $20 per share. The company is expected to pay a dividend of $1.00 next year and it should grow at 7% per year indefinitely. If the tax rate is 40%, what is the weighted average cost of capital? 2. (10 points) You are an outside analyst attempting to estimate the cost of capital for SSK Industrial. You do not know the corporation's target capital structure. However, the balance sheet shows a total of $55 million of long term debt with a coupon rate of 8%. The yield to maturity is 10.70% (before tax) and the total current market value is $50 million. The balance sheets also show the total of common stock and retained earnings is $60 million. The company's stock has a beta of 1.80 and the stock price is $10.00 per share. There are 8 million shares of stock outstanding, and the current risk free rate is 3%. The company recently paid a dividend of $0.70, and they typically pay out about 25% of their earnings in cash dividends. SSK's return of equity is 10% and the expected return on the market is 9.50%. What is your estimate of SSK's weighted average cost of capital if their marginal tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts