Question: show all work using formulas, please and thankyou. 1. Answer the following questions regarding currency options. A. (1 point) Suppose you set up a long

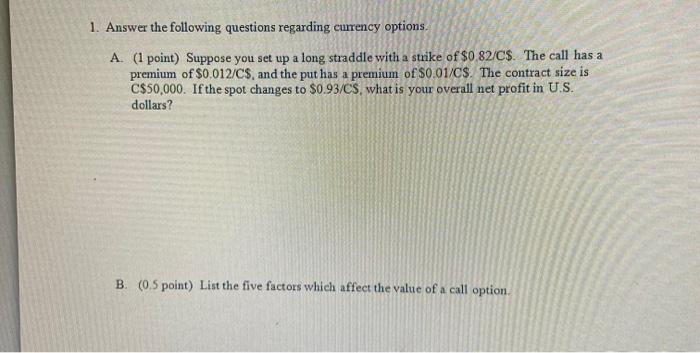

1. Answer the following questions regarding currency options. A. (1 point) Suppose you set up a long straddle with a strike of $0.82/C$. The call has a premium of $0.012/C$, and the put has a premium of $0.01/0$. The contract size is C$50,000. If the spot changes to $0.93/CS, what is your overall net profit in U.S. dollars? B. (0.5 point) List the five factors which affect the value of a call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts