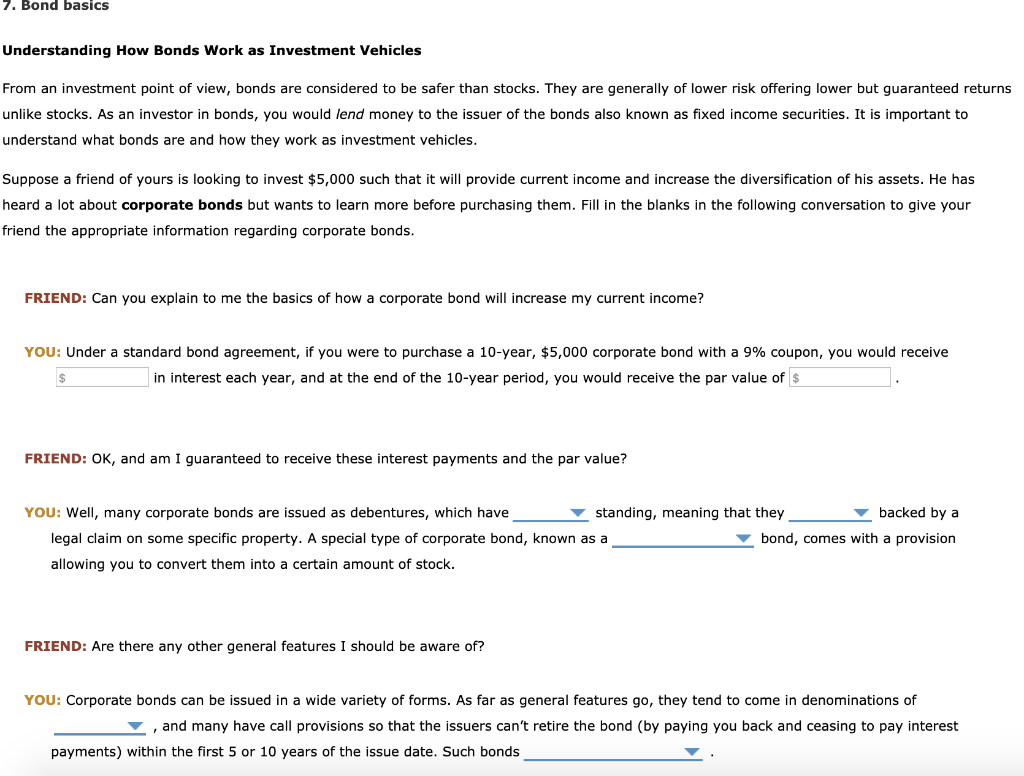

Question: DROP DOWN OPTIONS 1. (junior / senior) 2. (are / are not) 3. (flexible / stock-optioned / convertible) 4. (1,000 / 10,000 / 100) 5.

DROP DOWN OPTIONS

1. (junior / senior)

2. (are / are not)

3. (flexible / stock-optioned / convertible)

4. (1,000 / 10,000 / 100)

5. (are freely callable / are noncallable / carry a deferred call)

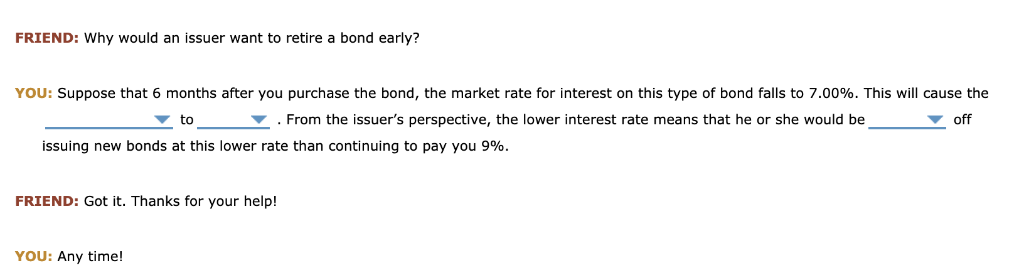

6. (coupon / market price / par value)

7. (fall / rise)

8. (better / worse)

7. Bond basics Understanding How Bonds Work as Investment Vehicles From an investment point of view, bonds are considered to be safer than stocks. They are generally of lower risk offering lower but guaranteed returns unlike stocks. As an investor in bonds, you would lend money to the issuer of the bonds also known as fixed income securities. It is important to understand what bonds are and how they work as investment vehicles. Suppose a friend of yours is looking to invest $5,000 such that it will provide current income and increase the diversification of his assets. He has heard a lot about corporate bonds but wants to learn more before purchasing them. Fill in the blanks in the following conversation to give your friend the appropriate information regarding corporate bonds. FRIEND: Can you explain to me the basics of how corporate bond will increase my current income? YOU: Under standard bond agreement, if you were to purchase a 10-year, $5,000 corporate bond with a 9% coupon, you would receive in interest each year, and at the end of the 10-year period, you would receive the par value of $ FRIEND: OK, and am I guaranteed to receive these interest payments and the par value? standing, meaning that they backed by a YOU: Well, many corporate bonds are issued as debentures, which have legal claim on some specific property. A special type of corporate bond, known as a bond, comes with a provision allowing you to convert them into a certain amount of stock FRIEND: Are there any other general features I should be aware of? YOU: Corporate bonds can be issued in a wide variety of forms. As far as general features go, they tend to come in denominations of ,and many have call provisions so that the issuers can't retire the bond (by paying you back and ceasing to pay interest payments) within the first 5 or 10 years of the issue date. Such bonds bond early? FRIEND: Why would an issuer want to retire YOU: Suppose that 6 months after you purchase the bond, the market rate for interest on this type of bond falls to 7.00%. This will cause the vFrom the issuer's perspective, the lower interest rate means that he or she would be off to issuing new bonds at this lower rate than continuing to pay you 9%. FRIEND: Got it. Thanks for your help! YOU: Any time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts