Question: Show all working please. Any incorrect or spammed answers will result in the user getting reported and down voted. While all correct answers will be

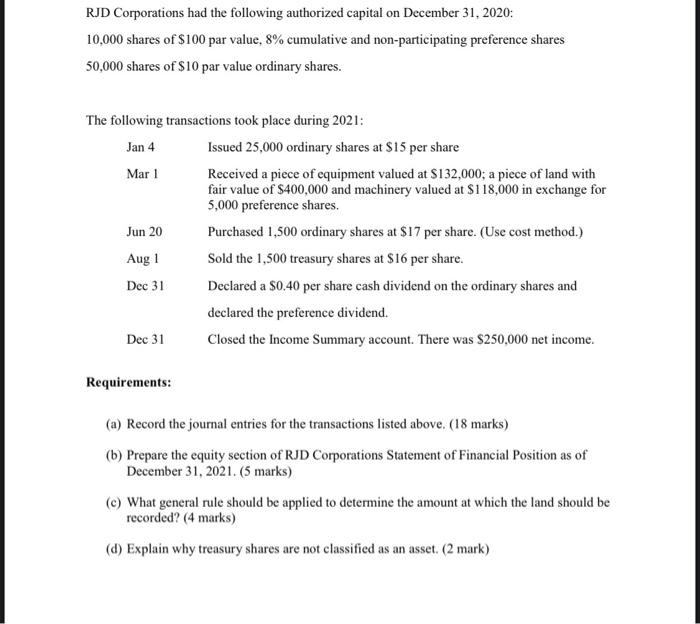

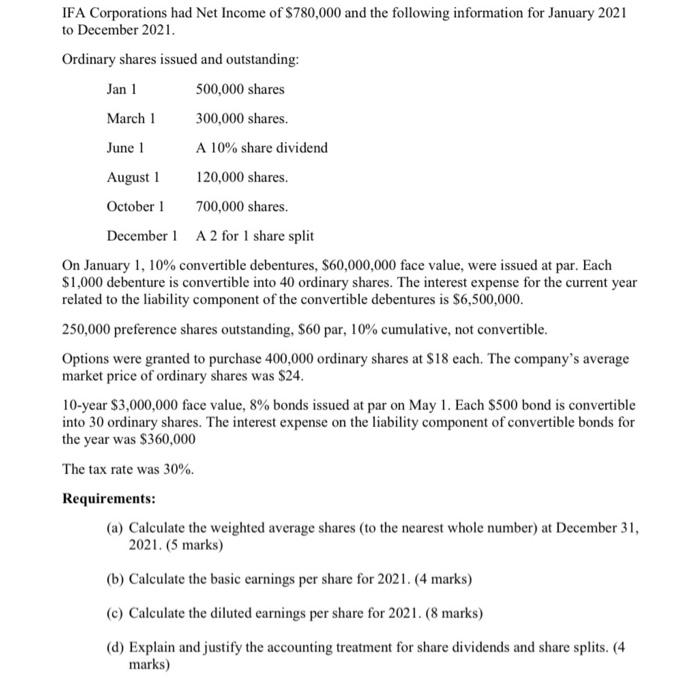

RJD Corporations had the following authorized capital on December 31, 2020: 10,000 shares of $100 par value, 8% cumulative and non-participating preference shares 50,000 shares of $10 par value ordinary shares. The following transactions took place during 2021: Jan 4 Issued 25,000 ordinary shares at $15 per share Mar 1 Received a piece of equipment valued at $132,000; a piece of land with fair value of $400,000 and machinery valued at $118,000 in exchange for 5,000 preference shares. Jun 20 Purchased 1,500 ordinary shares at $17 per share. (Use cost method.) Aug 1 Sold the 1,500 treasury shares at $16 per share. Dec 31 Declared a $0,40 per share cash dividend on the ordinary shares and declared the preference dividend. Dec 31 Closed the Income Summary account. There was $250,000 net income. Requirements: (a) Record the journal entries for the transactions listed above. (18 marks) (b) Prepare the equity section of RJD Corporations Statement of Financial Position as of December 31, 2021. (5 marks) (e) What general rule should be applied to determine the amount at which the land should be recorded? (4 marks) (d) Explain why treasury shares are not classified as an asset. (2 mark) IFA Corporations had Net Income of $780,000 and the following information for January 2021 to December 2021. Ordinary shares issued and outstanding: Jan 1 500,000 shares March 1 300,000 shares. June 1 A 10% share dividend August 1 120,000 shares. October 1 700,000 shares. December 1 A 2 for 1 share split On January 1, 10% convertible debentures, $60,000,000 face value, were issued at par. Each $1,000 debenture is convertible into 40 ordinary shares. The interest expense for the current year related to the liability component of the convertible debentures is $6,500,000. 250,000 preference shares outstanding, $60 par, 10% cumulative, not convertible. Options were granted to purchase 400,000 ordinary shares at $18 each. The company's average market price of ordinary shares was $24. 10-year $3,000,000 face value, 8% bonds issued at par on May 1. Each $500 bond is convertible into 30 ordinary shares. The interest expense on the liability component of convertible bonds for the year was $360,000 The tax rate was 30%. Requirements: (a) Calculate the weighted average shares (to the nearest whole number) at December 31, 2021. (5 marks) (b) Calculate the basic earnings per share for 2021. (4 marks) (c) Calculate the diluted earnings per share for 2021. (8 marks) (d) Explain and justify the accounting treatment for share dividends and share splits. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts