Question: Show all working please. Any incorrect or spammed answers will result in the user getting reported and down voted While all correct answers will be

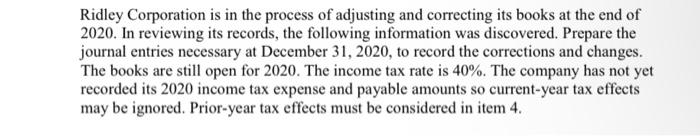

Ridley Corporation is in the process of adjusting and correcting its books at the end of 2020. In reviewing its records, the following information was discovered. Prepare the journal entries necessary at December 31, 2020, to record the corrections and changes. The books are still open for 2020. The income tax rate is 40%. The company has not yet recorded its 2020 income tax expense and payable amounts so current-year tax effects may be ignored. Prior-year tax effects must be considered in item 4. 4. Before 2020, Ridley accounted for its income from long-term construction contracts on the cost-recovery basis. Early in 2020, the company changed to the percentage-of- completion basis for accounting purposes. It continues to use the cost-recovery method for tax purposes. Income for 2020 has been recorded using the percentage-of-completion method. Pretax Income from Percentage-of-Completion Cost-Recovery Prior to 2020 $150,000 $105,000 2020 60,000 20,000 (3 marks) 5. A collection of $5,600 on account from a customer received on December 31, 2020, was not recorded until January 2, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts