Question: Show all your work in solving the problems. You don't need to provide formulas but do need to show all calculator keystrokes to get full

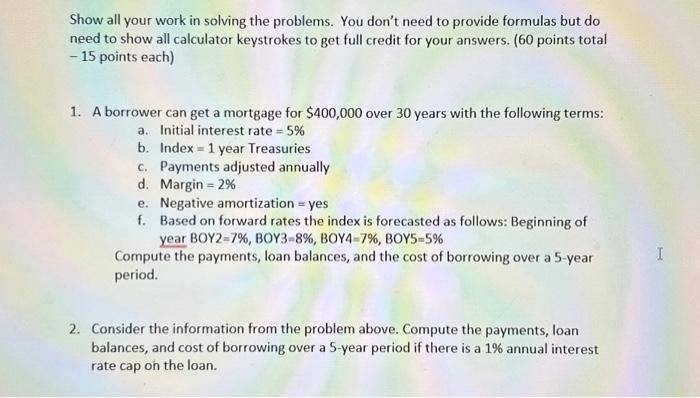

Show all your work in solving the problems. You don't need to provide formulas but do need to show all calculator keystrokes to get full credit for your answers. (60 points total -15 points each) 1. A borrower can get a mortgage for $400,000 over 30 years with the following terms: a. Initial interest rate =5% b. Index =1 year Treasuries c. Payments adjusted annually d. Margin =2% e. Negative amortization = yes f. Based on forward rates the index is forecasted as follows: Beginning of year BOY2=7%,BOY3=8%, BOY 4=7%, BOY 5=5% Compute the payments, loan balances, and the cost of borrowing over a 5 -year period. 2. Consider the information from the problem above. Compute the payments, loan balances, and cost of borrowing over a 5 -year period if there is a 1% annual interest rate cap on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts