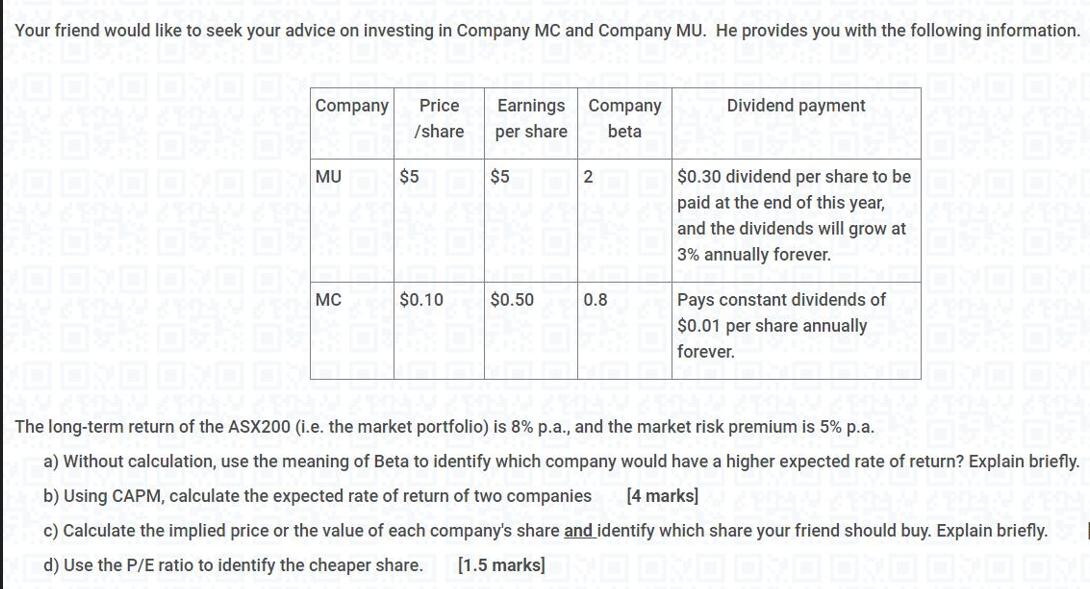

Question: Your friend would like to seek your advice on investing in Company MC and Company MU. He provides you with the following information. Company

Your friend would like to seek your advice on investing in Company MC and Company MU. He provides you with the following information. Company Price Earnings Company /share per share beta $5 2 MU DEMC $5 $0.10 $0.50 0.8 Dividend payment $0.30 dividend per share to be paid at the end of this year, and the dividends will grow at 3% annually forever. Pays constant dividends of $0.01 per share annually forever. The long-term return of the ASX200 (i.e. the market portfolio) is 8% p.a., and the market risk premium is 5% p.a. a) Without calculation, use the meaning of Beta identify which company would have a higher expected of return? Explain briefly. b) Using CAPM, calculate the expected rate of return of two companies [4 marks] c) Calculate the implied price or the value of each company's share and identify which share your friend should buy. Explain briefly. d) Use the P/E ratio to identify the cheaper share. [1.5 marks]

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

The provided image contains a set of questions related to investment advice in two companies MU and MC Lets address each of the questions step by step a Without calculation use the meaning of Beta to ... View full answer

Get step-by-step solutions from verified subject matter experts