Question: show answer in detail please 55) Use the binomial option pricing model to find the value of a call option on 10,000 with a strike

show answer in detail please

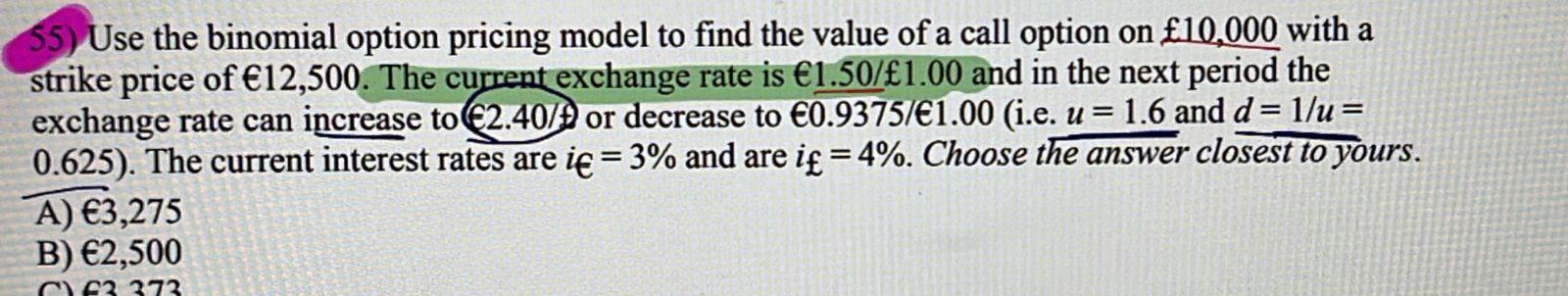

55) Use the binomial option pricing model to find the value of a call option on 10,000 with a strike price of 12,500. The current exchange rate is 1.50/1.00 and in the next period the exchange rate can increase to 2.40/ or decrease to 0.9375/1.00 (i.e. u=1.6 and d=1/u= 0.625). The current interest rates are ie = 3% and are i = 4%. Choose the answer closest to yours. A) 3,275 B) 2,500 = C) 22 373 55) Use the binomial option pricing model to find the value of a call option on 10,000 with a strike price of 12,500. The current exchange rate is 1.50/1.00 and in the next period the exchange rate can increase to 2.40/ or decrease to 0.9375/1.00 (i.e. u=1.6 and d=1/u= 0.625). The current interest rates are ie = 3% and are i = 4%. Choose the answer closest to yours. A) 3,275 B) 2,500 = C) 22 373

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts