Question: Show calculation and beliefs discuss! Thank you Problem 4: Using the table and information below to calculate the following: The value of the stock is

Show calculation and beliefs discuss! Thank you

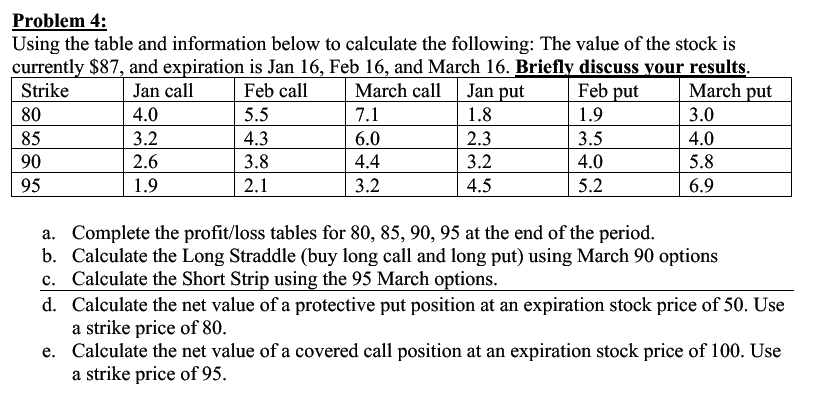

Problem 4: Using the table and information below to calculate the following: The value of the stock is currently $87, and expiration is Jan 16, Feb 16, and March 16. Briefly discuss your results. Strike Jan call Feb call March call Jan put Feb put M arch put 80 0 4. 5 5 . 7 .1 1.8 1.9 3.0 85 3.2 4.3 6.0 2.3 3.5 4.0 | 90 2.6 3.8 4.4 3.2 4.0 5.8 | 95 | 1.9 2.1 3.2 4.5 5.2 6.9 a. Complete the profit/loss tables for 80, 85, 90, 95 at the end of the period. b. Calculate the Long Straddle (buy long call and long put) using March 90 options c. Calculate the Short Strip using the 95 March options. d. Calculate the net value of a protective put position at an expiration stock price of 50. Use a strike price of 80. e. Calculate the net value of a covered call position at an expiration stock price of 100. Use a strike price of 95. Problem 4: Using the table and information below to calculate the following: The value of the stock is currently $87, and expiration is Jan 16, Feb 16, and March 16. Briefly discuss your results. Strike Jan call Feb call March call Jan put Feb put M arch put 80 0 4. 5 5 . 7 .1 1.8 1.9 3.0 85 3.2 4.3 6.0 2.3 3.5 4.0 | 90 2.6 3.8 4.4 3.2 4.0 5.8 | 95 | 1.9 2.1 3.2 4.5 5.2 6.9 a. Complete the profit/loss tables for 80, 85, 90, 95 at the end of the period. b. Calculate the Long Straddle (buy long call and long put) using March 90 options c. Calculate the Short Strip using the 95 March options. d. Calculate the net value of a protective put position at an expiration stock price of 50. Use a strike price of 80. e. Calculate the net value of a covered call position at an expiration stock price of 100. Use a strike price of 95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts